It appears that the market has once again proven wrong some conventional wisdoms held by Wall Street and expected by some traders. As Lu Wang and Ye Xie wrote for Bloomberg News, consensus bets are losing as the US economy defies the recession bears and Chinese stocks deteriorate into a bear market while the artificial-intelligence craze heats up.

Some failing strategies include selling Big Tech stocks, downplaying the US dollar, and expecting that growth in China would surge following the end of covid lockdowns. Instead, US growth shares are rising as the US dollar has strengthened, including a 6% surge versus the Japanese yen.

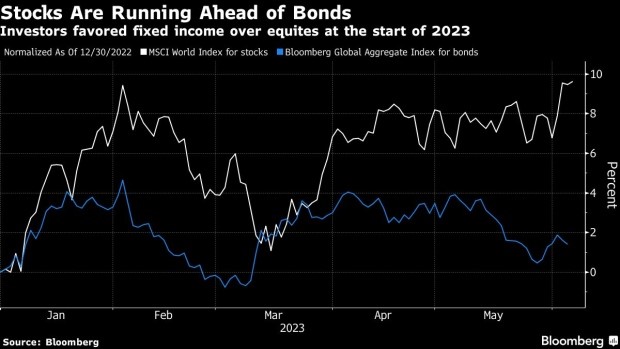

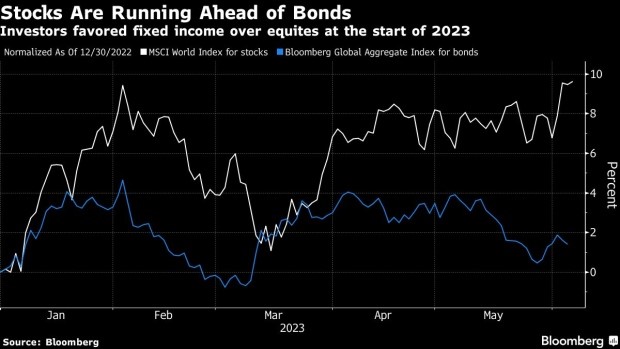

Stocks have outperformed fixed income: the MSCI index tracking global shares is up 10%, compared with a gain of 1.4% from bonds worldwide as tracked by Bloomberg.

In a December survey of fund managers by Bank of America Corp., government bonds were forecast to be the best-performing asset in 2023. In the US, Treasuries have advanced, but they are far behind the performance of stocks, trailing by 7 percentage points in the first five months of 2023.

The optimism around AI following the release of ChatGPT last November is behind the bulk of the growth in equities. This optimism has fueled the growth of such stocks as Microsoft Corp. (up almost 40% year-to-date) and Nvidia Corp. (up almost 195% year-to-date).

As a result of AI euphoria and better-than-expected corporate earnings and economic data, the S&P 500 index is now up almost 14% since the beginning of the year and some expectations are that a bull market will follow.

At the same time, some analysts think that the previous strategies may still prove correct due to the aftershocks from the aggressive Fed tightening campaign.

Bloomberg News quoted Kristen Bitterly, head of North American investments at Citi Global Wealth Management, that the tighter financial conditions still make it more challenging both from a consumer standpoint as well as a corporate standpoint. We’ll see if the second half of 2023 provides any optimism for expected government bond and Chinese equity outperformance.

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

Share on Social Media