Alexander Dalziel, National Post.

Another foreign visit, another plea for Canadian liquified natural gas unanswered. Greek Prime Minister Kyriakos Mitsotakis, who was in Canada March 24 and 25, got the same cool reception that his peers from Japan and Germany in their calls for Canadian liquefied natural gas (LNG) exports.

Why the indifference? Enter the dreaded rhetoric of the Canadian “business case,” the habit in domestic policy discourse to dismiss LNG exports to Europe as unviable — despite repeated asks from Europeans themselves.

This lens fails to acknowledge the transformation underway in the international political economy. The 1990s were the heyday of rationalist economic thinking, when a past blighted by politics was being left behind for an optimal future of market signals and consumer preferences. This period of enlightenment has given way to a dirty present, where politics is back with a vengeance in economic decision-making. In the 1990s, efficiency was the idol; now redundancy is a cardinal virtue.

So, as Canada’s infrastructure investment has atrophied, others have taken a different approach — and it’s paid off handsomely.

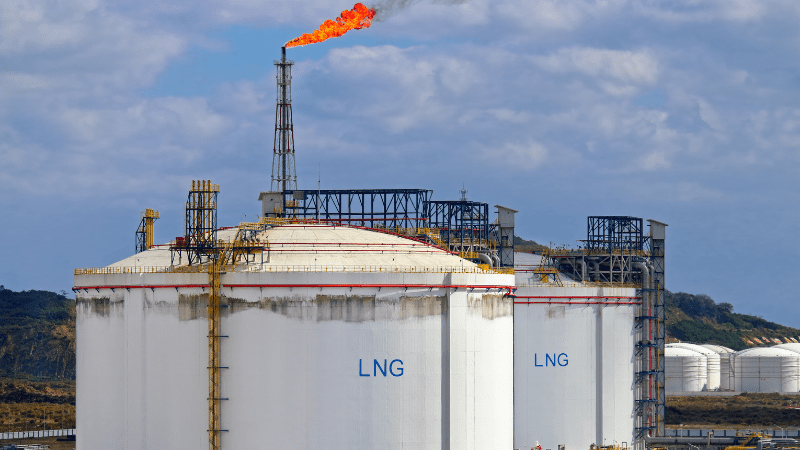

Consider Lithuania. In 2011, its electricity grid relied entirely on gas from Russia’s state-owned Gazprom. Fed up with the exorbitant prices it was being charged, Lithuania’s government decided to intervene and took the significant financial risk of self-funding, without European Union (EU) support, the construction of an LNG regasification plant. It was operating by late 2014 and paid immediate dividends: Gazprom, its monopoly broken, had to offer better prices, and by 2018 Lithuania was paying it about 50 per cent less for gas.

After Russia’s full invasion of Ukraine in 2022, Lithuania halted Russian imports. Its LNG infrastructure proved invaluable not just to its economic stability and national security, but more broadly to European energy security, particularly that of Estonia, Latvia and Poland. Despite a weak “business case” in 1990s economic terms, Lithuania’s political choices created resilience and a better life for its citizens.

It took Russia’s bald aggression against Ukraine for the rest of Europe to fully learn the Lithuanian lesson. In 2021, Russia accounted for about 40 per cent of EU gas imports. Late last year it was down to 16 per cent. Europe now relies heavily instead on Norwegian and Algerian pipelines for natural gas, accounting for 40 per cent of total gas imports late last year from 30 per cent in early 2021; meanwhile, LNG from the United States now accounts for about 20 per cent of all gas imports, up from about five per cent over the same period, according to the Bruegel think tank.

Suppliers in the Middle East have been busy, too. Qatar in particular has been signing long-term contracts to provide LNG to Germany, France and the Netherlands. Norway and the U.S. are unquestionably reliable suppliers, but in the longer term, Qatar, with its head-spinning reserves of natural gas, is likely to grow its European market share.

Although few would question its commitment to customers, Qatar is located in a fractious region, where a conflict in the Persian Gulf would compromise its shipping routes, adding a heightened element of geopolitical risk. Should such risk manifest itself, Europe in the decades ahead may again face a serious energy crunch.

We don’t need to just limit the conversation to the future. Qatar’s example indicates that European market share is still available. Despite the precipitous drop in pipeline gas, Russian LNG exports to the EU have continued unabated as members can’t find enough gas to replace it. As of February, it was still the second-largest exporter to European customers. So, an LNG export facility on Canada’s East Coast would have sound prospects in the medium term to ship to Europe and replace Russian LNG, even barring new geopolitical upsets (which are pretty much inevitable). This suggests a sustainable market with upside potential.

Canadian natural gas would be another long-term reliable source. Probably the single most effective thing Canada could do for Ukraine would be to wean Europe off the remaining gas it gets from Russia.

Canada has shown it is willing to place massive financial bets on battery manufacturing. A similar mentality should apply to natural gas, which is also essential to the energy transition. It has growth prospects for at least the next two decades. Canada’s reputation as a reliable supplier to allied and partner nations is likely to prove a competitive asset.

And the Lithuanians, and more recently the Germans, have shown that LNG infrastructure can be put in place, fast. Germany got an LNG import terminal up and running within a year in 2022. We should dare to act. That would show Canada means business.

Alexander Dalziel is a senior fellow at the Macdonald-Laurier Institute.

Note from the editor:

This column is yet another appeal to the Canadian federal government regarding Canada’s LNG supplies to the global, and most importantly, European markets. The bulk of the international community continues to fund Russian aggression in Ukraine. This is true not only of the countries of the Global South but also of Western countries. Some could have stopped paying Russia, and others, like Canada, could have helped them. While the West is assisting Ukraine financially and militarily, it is simultaneously providing funds to Russia for its oil, gas, uranium, fertilizers, metals, and many other commodities, thereby enabling the continuation of the war. Meanwhile, Ukrainian soldiers and civilians, including children, women, and the elderly, are caught in the crossfire and perish daily.

Canada had ample time to commence exporting its LNG before February 24, 2022, and has had over two years since then to do so. For quite some time, there has been a compelling business case and a pressing need for such action. By now, we could have achieved this or at least made significant progress, even if we had started in February 2022. While Canada boasts about the dollars, military training, and equipment provided to Ukraine, in reality, it has done little to halt Russian aggression. In 2022 and 2023, Canada increased its oil and gas exports by 200,000 barrels per day and 250,000 barrels per day, respectively, in line with Minister of Energy and Natural Resources of Canada Jonathan Wilkinson’s promise made in April 2022 to increase exports by 300,000 bpd. Meanwhile, Ukraine has recently knocked out an estimated 600,000 bpd of Russian refinery capacity, eliciting a backlash from Western countries.

According to market experts, 300,000 bpd is the maximum by which Canada could increase its oil and gas exports. If Canada had invested sufficiently in its energy infrastructure, it could have significantly curtailed Russian oil and gas exports without firing a shot, thereby lowering global petrol and natural gas prices. While Ukraine continues to suffer, facing criticism from global elites for raising global oil prices.

The assistance Canada has provided to Ukraine, although critically insufficient, is causing irritation among wide circles of Canadian society amid economic recession and declining living standards. I daresay that if Canada had not provided Ukraine with a penny but instead pushed Russia out of the global energy markets (thereby reducing global CO2 emissions because Russia’s fossil fuels emit much more than Canada’s), it would have had a significantly larger impact on Ukraine. It could have prevented the war. It could have stopped the war. And it would have undoubtedly boosted the Canadian economy.

The silence of the Ukrainian Canadian community on this glaring issue is noteworthy. While Canadian mainstream media, experts, and politicians have extensively covered the lack of Canadian LNG exports, the closest Ukrainian Canadians have recently come to discussing the issue of Russian energy revenues was the opinion that the U.S. needs to increase its LNG supplies. Why have we, as a community, not raised the issue of Canadian LNG supplies? Canada possesses world-class natural gas reserves but only exports natural gas to third countries through the U.S. While the U.S. has already done its fair share and exported more LNG than any other country in 2023. Apart from several articles in this newspaper and segments on Kontakt Ukrainian TV, there has been no discussion from the community or its organizations on this matter (please correct me if I am wrong).

But it’s never too late. Canada can still help the world to get rid of Russian oil and gas. And the Ukrainian Canadian community can still endeavor to encourage the Canadian government to act on this matter.

Yuri Bilinsky

Managing Editor, NP-UN

Share on Social Media