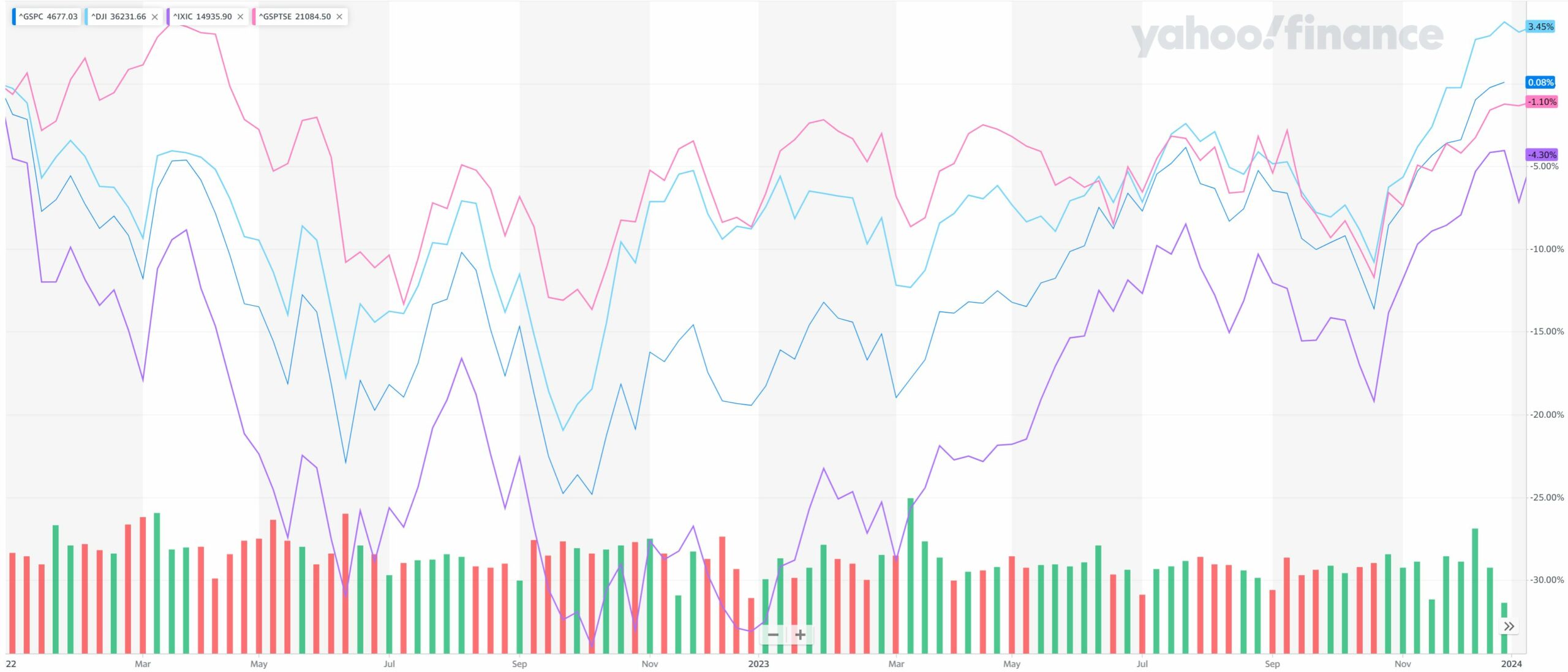

S&P 500, DJIA, Nasdaq and S&P /TSX Composite indices in 2022-2023

For stock markets, 2023 brought some relief from the poor performance of 2022. All major U.S. stock indices showed strong recovery: the S&P 500 jumped 24.23%, the Dow Jones Industrial Average gained 13.8% and the Nasdaq 100 surged 43.42%.

However, these gains didn’t fully compensate for the losses of 2022. Only the S&P 500 showed some increase over the past two-year period while the Dow was flat and NASDAQ was down over that two-year period.

The past year showed how difficult it is to predict and navigate stock markets. After the challenging 2022, expectations of an economic recession were widespread. That did not materialize in the U.S. but there were other factors that complicated stock market forecasts, namely four interest rate hikes by the Federal Reserve, a regional banking crisis in the U.S., continued war in Ukraine and the outbreak of war in Israel. Despite these negative factors, the American stock market showed strength.

The trend on the Canadian stock market was similar. In 2023, the S&P/TSX composite index grew by nearly 8%. This growth did not compensate for the decline in 2022 when the index lost nearly 9%.

The S&P/TSX composite had a good run in the final quarter of 2023 on hopes of an interest rate cuts by the Bank of Canada. However, this growth has not been enough for the index to recoup all the negative territory and it is currently still trading below its peak levels of late 2021. Going forward, inflationary pressures, which are not slowing enough, may negatively influence the Canadian stock market if they delay the widely expected rate cuts by the Bank of Canada.

In the U.S., many investors believe that inflation has been tamed and the economy will achieve a soft-landing. However, potential negative surprises may lead to a heightened level of instability in the market.

The Wealth Strategies Group of the Ukrainian Credit Union Limited offers professional advice on the stock markets. We are ready to guide you through the unstable markets to achieve your personalized long-term financial goals.

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

This is a paid advertisement

Share on Social Media