S&P/TSX Composite index (ca.finance.yahoo.com)

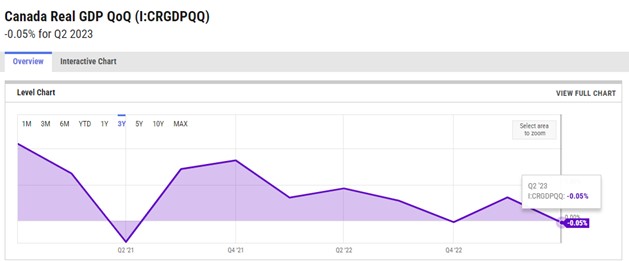

The preliminary gross domestic product estimate from Statistics Canada issued on October 31 showed that the Canadian economy may have entered a technical recession.

In August, GDP remained flat in the month, while a preliminary estimate suggests the economy continued that trend in September and shrank at an annualized rate of 0.1% in the third quarter. This would follow a contraction in the second quarter.

Source: ycharts.com

A technical recession is defined as two consecutive quarters of negative growth. However, economists are still hesitant to call the current slow-down a real recession as the declines are still relatively small.

The report says higher interest rates, inflation and extreme weather conditions continued to weigh on the economy. Eight out of 20 industries grew in August, Among the industries that experienced growth are wholesale trade and mining, quarrying, oil and gas extraction. This growth was offset by goods-producing sectors, such as agriculture and forestry, manufacturing, retail and accommodation and food services.

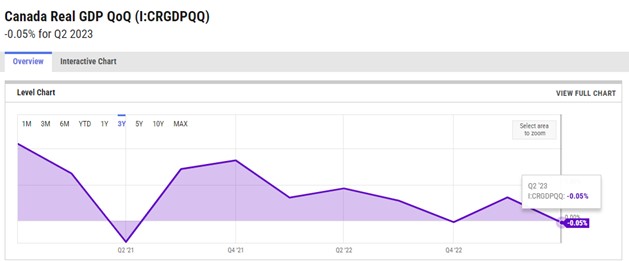

What effect will a potential economic slowdown have on the Canadian stock market?

The Canadian stocks have traded quite poorly the last two years. After dropping nearly 9% in 2022, the TSX Composite benchmark currently trades with about a loss of 3% year-to-date. The weakness has mainly been due to continued high inflation and rapidly rising interest rates.

The economic weakness has been behind the Bank of Canada’s decision to hold its key interest rate steady at 5% at its last two decision meetings. Current economic statistics support this decision. Many experts expect that the Canadian economy will remain weak in 2024 which will mean that there shouldn’t be any more interest rate hikes.

No further interest rate hikes and lower inflation (the latter stemming from the pullback in spending caused by higher borrowing costs) may not be supportive factors for stocks. The underlying factors of weak spending and economy will probably continue weighing on the overall Canadian stock market.

At the same time, the commodity-heavy S&P/TSX index may get some positive tailwinds from the commodity prices which remain strong.

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

Share on Social Media