Canadian stock market presents value after a period of underperformance

Feb 29, 2024 | Featured, Business

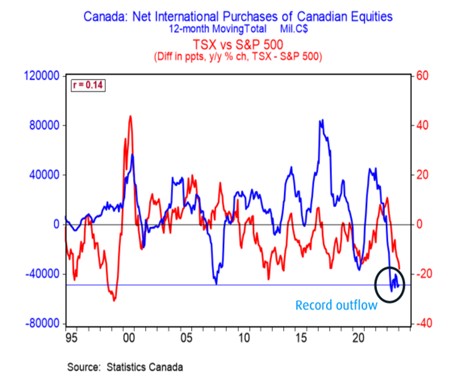

Source: BMO Capital Markets; Statistics Canada

Those thinking about investing in Canadian stocks or ETFs need to be aware of the following interesting statistics. A news outlet betterdwelling.com has just shared some recent analysis by BMO Capital Markets which shows that foreign investors have been exiting Canadian stocks over the last several months.

Canada’s main Canadian stock index S&P TSX has lagged behind the US indices for the past couple of years. The TSX index rose just 8.1% in 2023 compared to the S&P 500’s 24.2% over the same period. That underperformance has carried over into the opening weeks of 2024.

BMO notes that some of this underperformance can be attributed to significant selling by foreign investors. In fact, the main Canadian stock exchange TSX just saw sizable decrease of funds from foreign investors. Foreign investors sold a net of $48.7 billion worth of Canadian equities in 2023.

However, one of the main principles of successful investing is “buy low, sell high”. The underperformance of the market and pessimism by some investors create some good value opportunities to enter the market. The net international purchases of Canadian equities chart shows that global investors enter the Canadian market in cycles. The market currently is at a low point and holds a potential to turn strongly positive in the future.

Canada hosts many promising sectors and companies which present numerous opportunities for future growth. One of the examples is Canada’s mining sector as Canada’s metals and minerals are assuming an increasingly higher importance globally on the back of the international instability and the growing importance of security of critical supplies.

A prominent example of the Canadian mining segment to watch is uranium with which endured low prices for decades, but has recently grown in price rapidly amid ongoing supply concerns and a strong outlook for demand.

Such Canadian metals as lithium and copper could also recover in the future when the electric vehicle market revives.

Investors should also pay attention to the Canadian software and engineering sectors which host numerous promising companies with products and services that present significant value on the domestic and global markets.

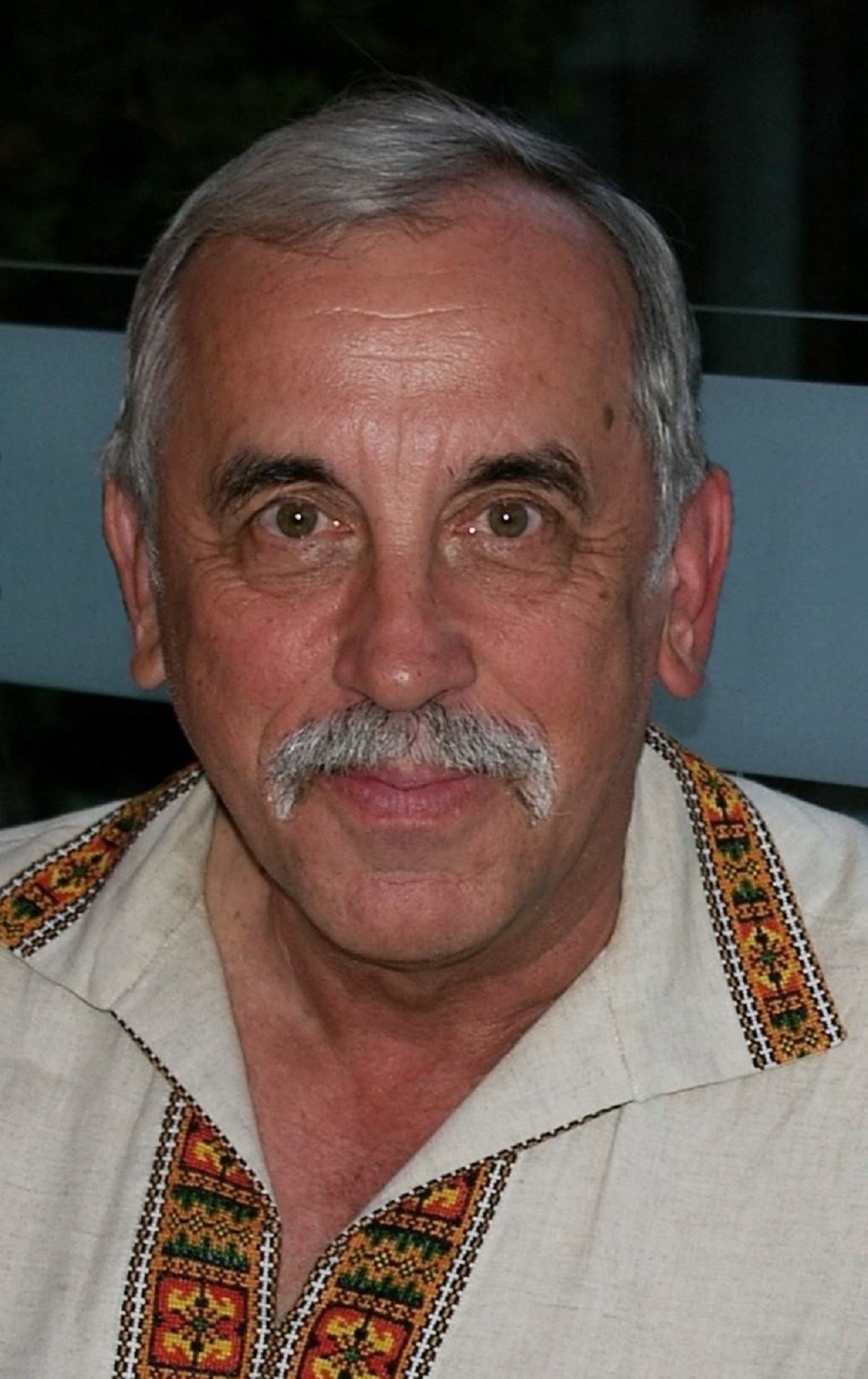

The Ukrainian Credit Union’s Wealth Strategies team is ready to assist you in making the most of today’s Canadian and international security markets.

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

This is a paid advertisement

Share on Social Media