UCU Investment Blog

For most individual investors, the 60/40 portfolio – a mix of 60% stocks and 40% bonds, has for a long time been a solid investment option. This so-called balanced portfolio is positioned to provide decent returns at moderate risk. In this portfolio, the minority position in bonds provides the ballast if the majority stake in stocks performs poorly.

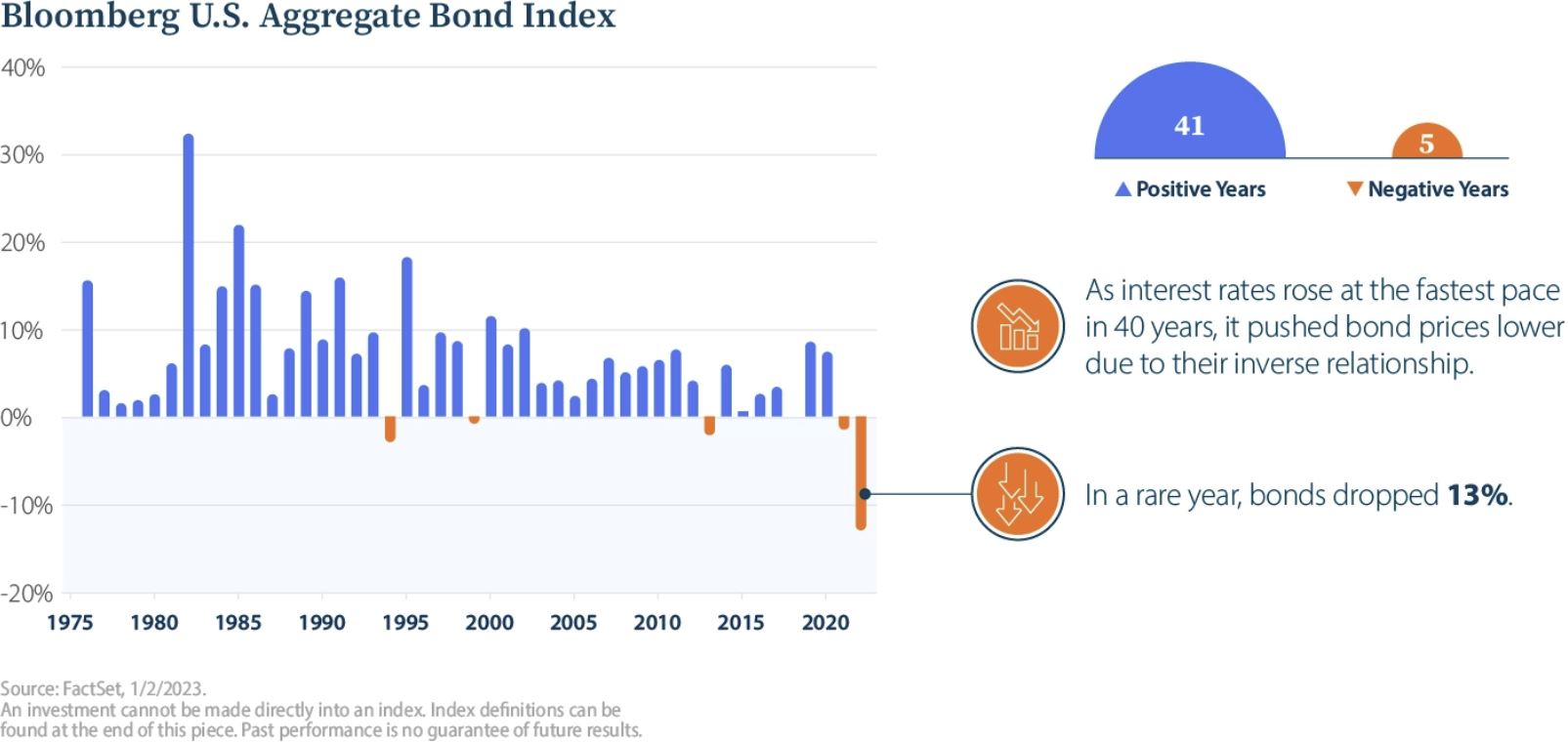

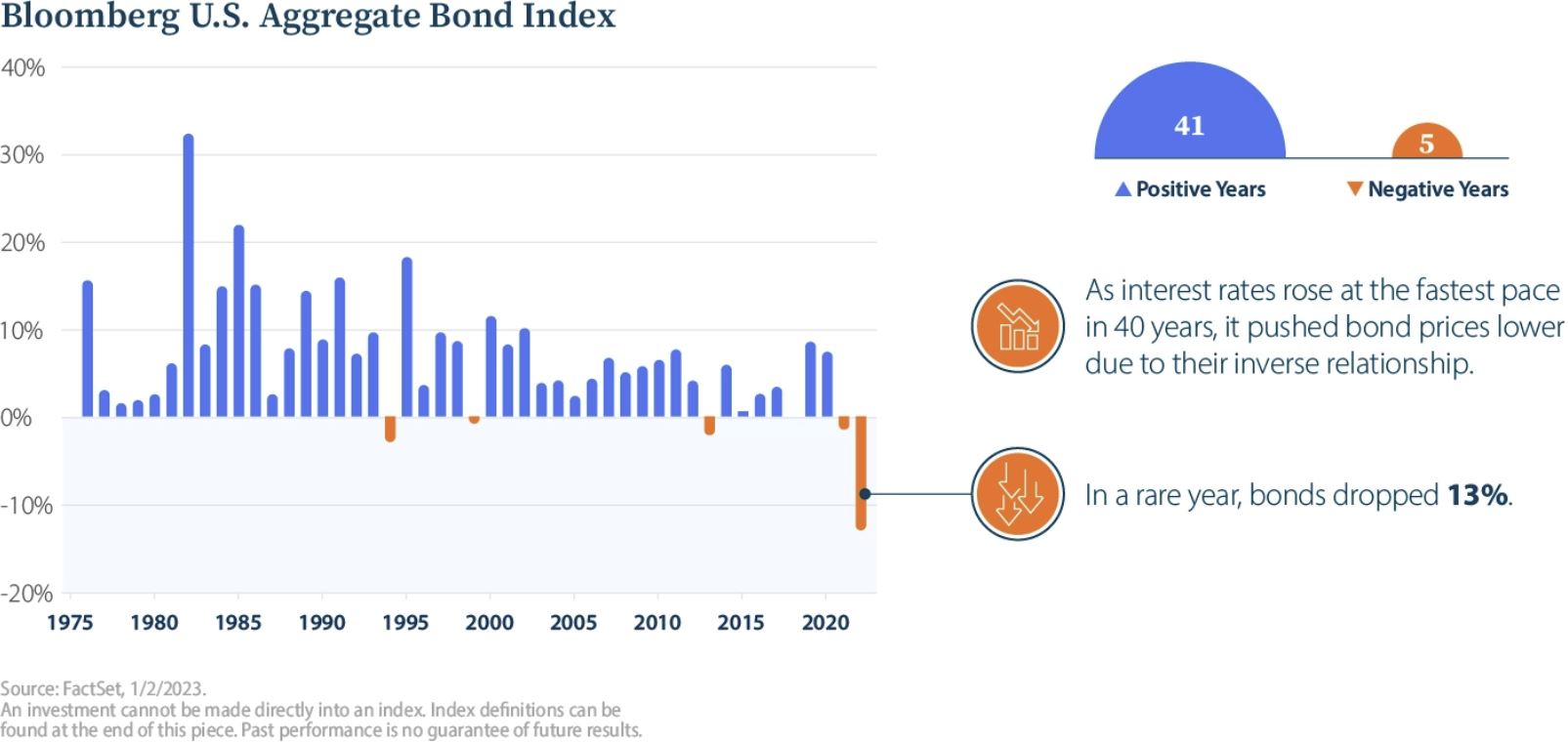

But, in 2022, both components of this portfolio, stocks and bonds, dropped significantly. The S&P 500 stock index fell 18% while bonds had their worst year ever, where the Bloomberg U.S. Aggregate Bond Index dropped 13%.

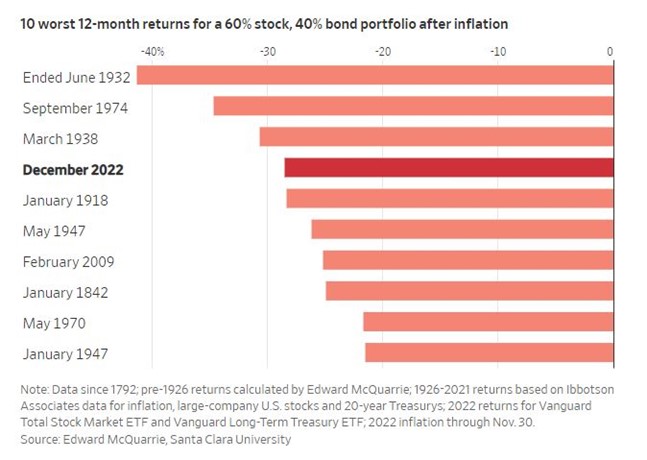

As a result, in 2022, 60/40 portfolios had their fourth worst year in history. A typical 60/40 portfolio lost about 15% last year; if its bonds were long-term, the losses were even deeper as long-term U.S. Treasuries dropped more than 29%.

The reason for the weak bond market was the rise in interest rates by the Federal Reserve and the Bank of Canada. After the Fed raised rates by 25 basis points last week (March 22, 2023) to the 4.75% to 5.00% range, uncertainty remains over the Fed’s further intentions which is creating investor hesitation in stocks and sparking swings in bond prices.

However, the interest-rate shock likely will not last much longer. Many experts, like Tony Rodriguez, head of fixed income strategy at Nuveen, expect that the Fed will stop raising and may start cutting rates by year-end. This would mean that bonds will again be able to effectively mitigate some of the risks of stocks.

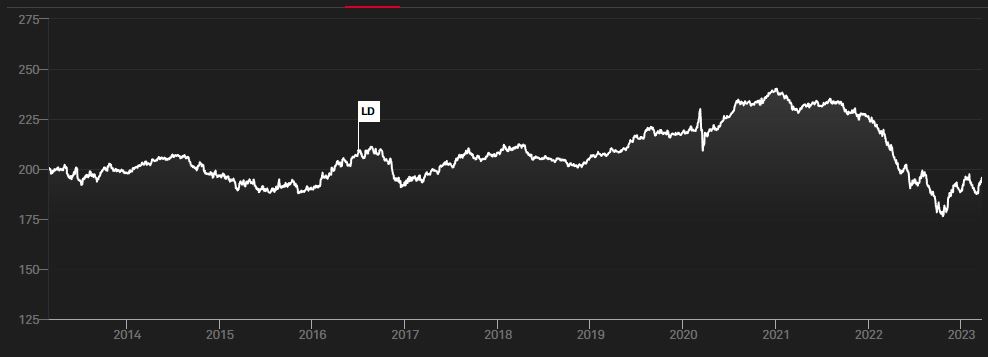

The total return on bonds has already bounced off its 10-year bottom, which was set in October 2022, as this chart of S&P Global Developed Aggregate Ex-Collateralized Bond Index shows.

If the worst for the bond market is indeed in the past, the future returns on fixed-income assets are now likely to bolster a 60/40 portfolio.

The Ukrainian Credit Union’s Wealth Strategies team is ready to help you navigate the often turbulent waters of today’s markets and select the best investment portfolio according to your risk/return profile. The investment markets are now offering numerous growth opportunities, as well as diversifiers such as fixed income, and we will be able to pick the right instruments to protect and grow your wealth.

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

Share on Social Media