The US dollar index measures the value of the US dollar relative to the basket of 6 global currencies: Euro (EUR), Japanese yen (JPY), British pound (GBP), Swiss frank (CHF), Canadian dollar (CAD) and Swedish krona (SEK). Because many securities and commodities are priced in US dollars, such as natural gas, oil, gold, copper, etc., the US Dollar Index can serve as an indicator of changes in the price of other securities and commodities. A stronger US Dollar index often means capital flight from global assets towards US assets, which can result in lower prices for securities like emerging market stocks. A weaker US Dollar index can cause a flight to “safe assets” like gold, if other risky assets are also lower.

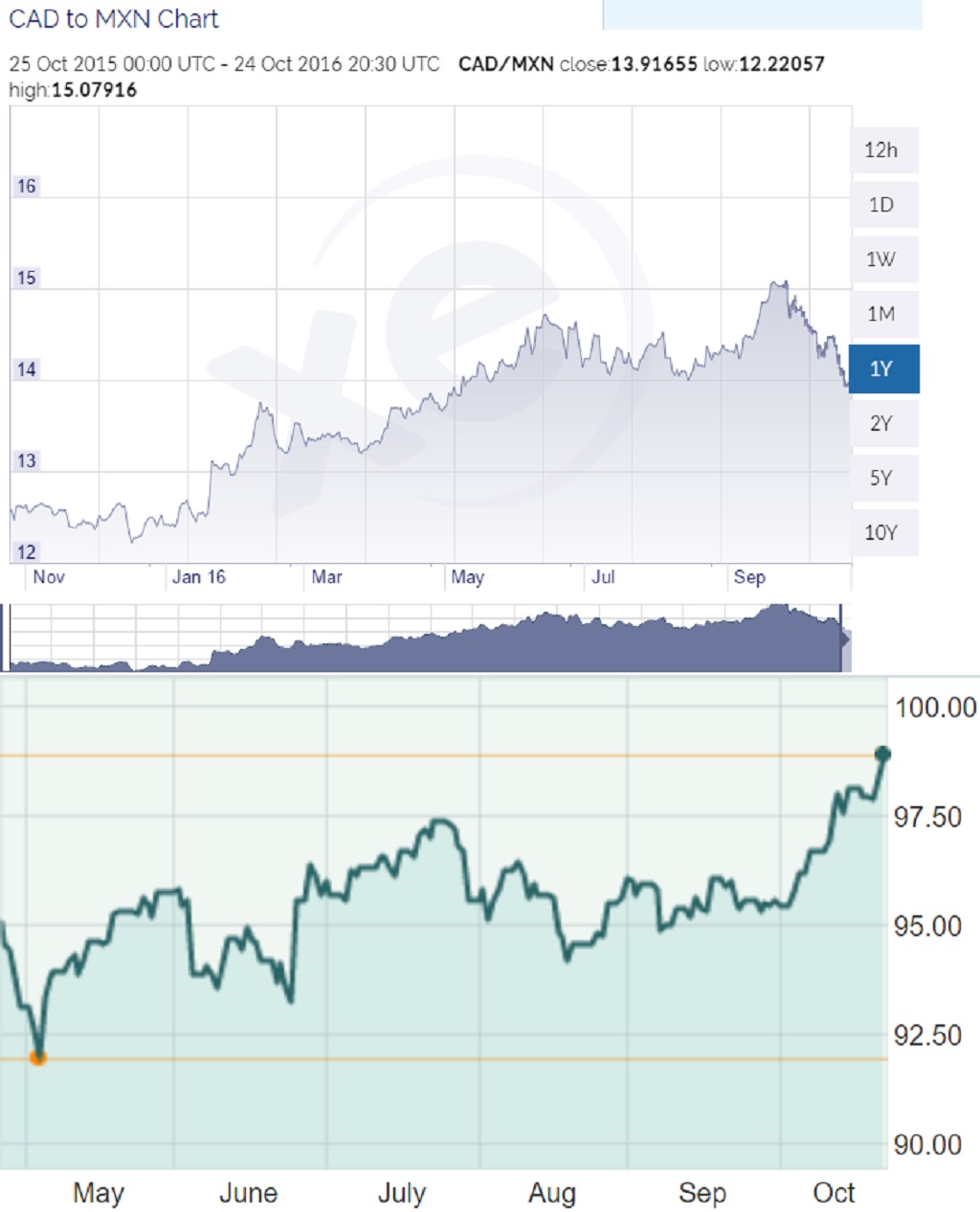

In the past six months, the US Dollar index has been steadily rising (see Chart 1). Since early May 2016, the index has grown by almost 7% to a level above 98. The rise has intensified recently due to the sharp decline of the British pound on the back of that country’s plans to exit the EU, and due to the prospects of an interest rate hike which the Federal Reserve is expected to carry out in December 2016. The outlook for higher interest rates in the US is creating global demand for the US dollar – a flight out of other assets towards US assets.

As was pointed out on economictimes.indiatimes.com, the index had risen above 98 in the second half of November and first half of December 2015, also ahead of the Fed’s policy meeting on December 16, 2015, when the US Federal Reserve raised rates for the first time since 2006. In that period, emerging market assets, using the Bombay Stock Exchange’s Sensex index as a proxy, drifted lower in value. Many market experts believe that there is a possibility of a similar trend in emerging market stocks this time around, which have seen a recent run-up since March 2016. They are facing a sell-off risk ahead of the Fed’s rate-setting meeting this December.

And the Canadian dollar, is it also feeling pressure from a strengthening US dollar? The Canadian dollar’s performance has been in line with the performance of the basket of top six currencies which comprise the US dollar index. CAD has fallen by more than 6% to USD since the US dollar started strengthening in May this year. Recently, the Canadian dollar dropped below 75 US cents, for the first time since March 2016.

There are several factors that have been affecting the Canadian dollar. First, low oil prices have kept the CAD weak relative to the USD. The recent price improvement for WTI Crude Oil (up around 14% over the past months) should have helped the CAD strengthen. However, a second factor has come into play which explains why the CAD fell more than 2% over two days (October 19-21) vs. the USD.

Given the continued weakness in the Canadian economy, the Bank of Canada appears to be seriously considering more interest rate cuts to stimulate economic growth. This would need to be balanced with the government’s objective of cooling what appears to be an overheated real estate market (lower interest rates would support higher real estate values). A still weaker CAD, though, could support the export sector. As Paul Ashworth, chief North American economist at Capital Economics, noted, “Canadian exporters are struggling to gain market share in the U.S. because Mexican competitors have enjoyed an even bigger devaluation.” The recent weakness of the Canadian dollar has softened the dollar as compared to the Mexican peso, but CAD is still considerably higher as compared to the peso than it was 12 months ago (see Chart 2).

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

Share on Social Media