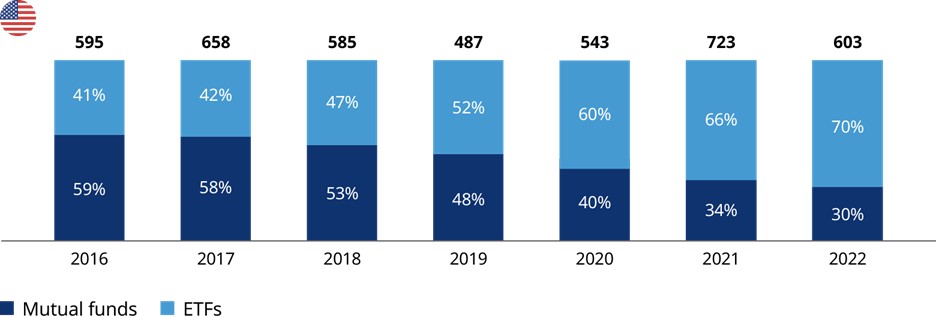

New fund launches of ETFs vs. mutual funds 2016-2022, number of funds, US. Source: 2023 Morningstar, Oliver Wyman analysis

Over the past 20 years, the rise of exchange-traded funds (ETFs) has been the major development in the asset management industry.

According to management consulting company Oliver Wyman, as of the end of December 2022, total ETF assets under management reached $6.7 trillion across the US and Europe, growing almost three times faster than traditional mutual funds since 2010.

In the US, the share of ETFs in the total number of new fund launches has grown significantly. In 2022, an estimated 70% of new fund launches were ETFs.

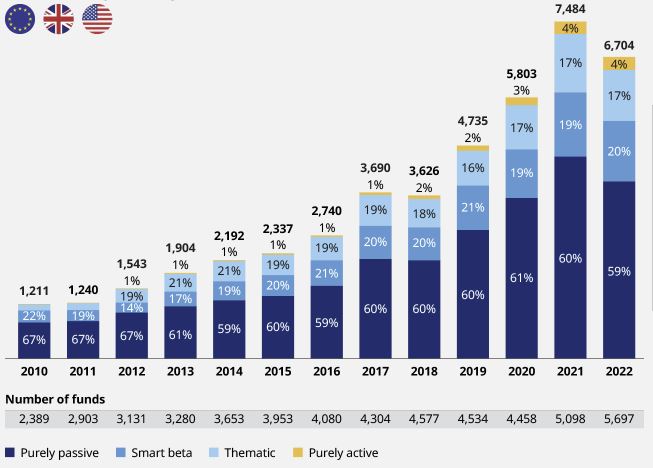

Historically, ETFs have been predominantly associated with passive investments — most often replicating performance of broad equity or commodity indices. But the next stage of growth, notes Oliver Wyman in its report, will be fueled by the rise of active ETFs.

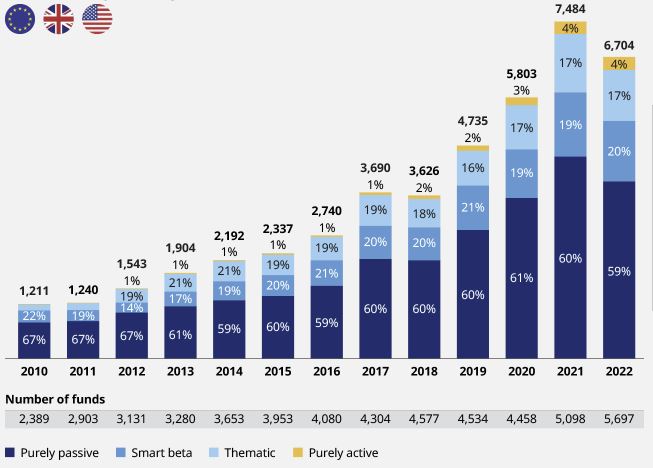

ETF market development by product segment

2010-2022, $ Billion AUM, Europe and US. Source: 2023 Morningstar, Oliver Wyman analysis

Active ETFs do not adhere to any passive investment strategy. These funds are managed by professional investors in an attempt to outperform a market index such as the S&P 500. A portfolio manager and a team of research analysts work to identify investments they think will do better or worse than the overall market and then position the fund’s portfolio accordingly.

Active ETFs are so popular because investors look for differentiated strategies to beat the market. Investors are also increasingly looking for products that meet their needs for environmental and socially responsible investing, as well as allow them to connect with contemporary themes.

This is driving significant growth in a theme-based and innovation-focused part of the ETF market, notes Oliver Wyman. Smaller fund providers that dominate this part of the market are outgrowing the large, traditional fund providers, which historically were able to leverage their scale to dominate a market that was driven by passive, low cost, plain vanilla investing products.

The ETF market can be differentiated by four main strategies: (1) purely passive, (2) smart beta, (3) thematic, and (4) purely active. From 2016 to 2022, the number of purely active ETF launches increased by 30% annually in the US and by 92% annually in Europe (see the chart).

Oliver Wyman’s report expects that, by 2027, ETFs will account for 24% of total fund assets, up from 17% today. Oliver Wyman also expects that this growth will disproportionately happen in innovative, active ETFs, which are characteristic with smaller market segments.

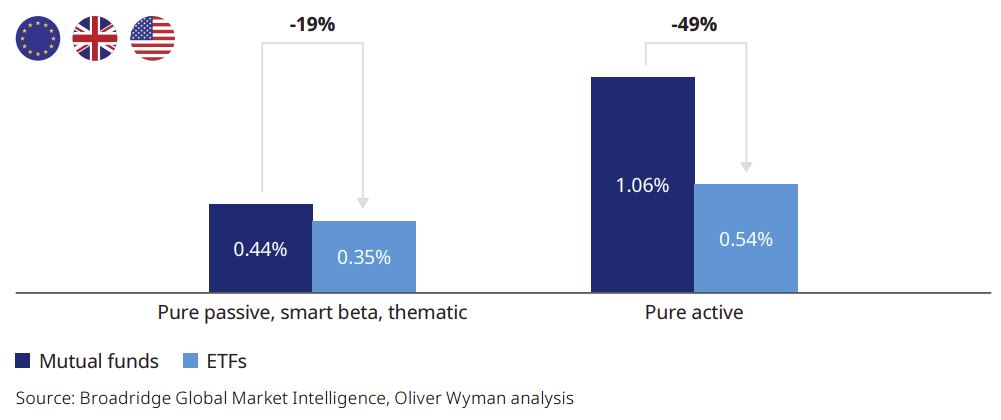

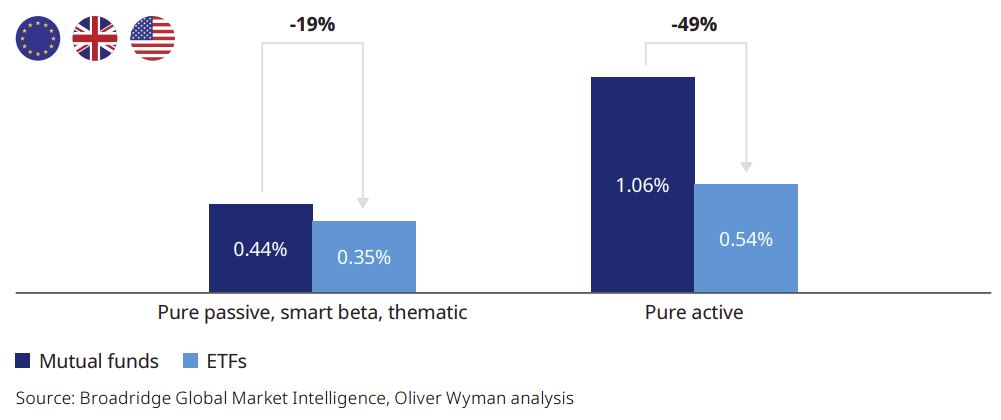

Among other factors, ETFs are gaining popularity because, on average, they tend to be cheaper than mutual funds. According to Oliver Wyman, the largest difference in management fees is observed in purely active funds, 49% as compared to 19% for purely passive funds, see the chart.

Management fees comparison by investment strategy

Oct 2022, average management fees in %, Europe and US. Source: Broadridge Global Market Intelligence, Oliver Wyman analysis

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

www.ukrainiancu.com

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc. Credential is a registered mark owned by Credential Financial Inc. and is used under license. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

Share on Social Media