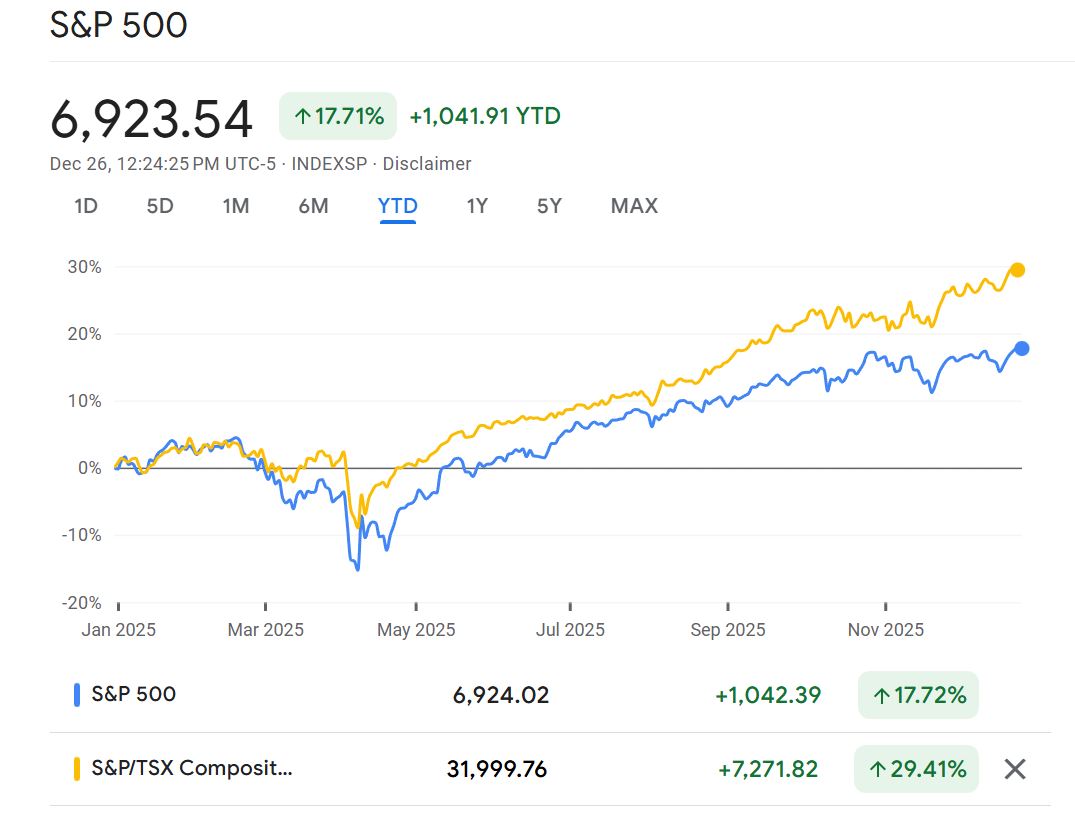

The Canadian dollar weakens against the U.S. dollar after rate cuts.

On September 17, two central banks lowered interest rates by 0.25 percentage point. The Bank of Canada reduced its overnight rate to 2.50% (Bank Rate 2.75%; deposit rate 2.45%). A few hours later, the U.S. Federal Reserve lowered the federal-funds rate to a 4.00%–4.25% range.

The decisions were similar; the language was not. The Bank of Canada said it stands ready to reduce rates again “if risks rise,” while the Fed’s statement and subsequent remarks from officials emphasized caution over stalling job market.

In the trading that followed, the U.S. dollar strengthened modestly against the Canadian dollar. By Monday, September 22, CAD/USD was around 1.38 (about 72.3 U.S. cents per Canadian dollar), roughly 0.3% weaker for CAD on the day and near the upper end of its recent range.

Canada’s August inflation data align with the Bank of Canada’s more open stance. Canada’s August CPI was 1.9% higher than a year earlier—near the 2% target. On a month-over-month basis, prices fell 0.1% unadjusted; seasonally adjusted, CPI rose 0.2%.

Energy prices also moved with the Canadian dollar in the same time period. On Friday, September 19, Brent crude settled near $66 per barrel and WTI near $63, both down on the week amid ample supply and demand concerns; prices hovered even lower from those levels into September 22. Lower oil prices typically soften Canada’s terms of trade and reduce incidental support for the currency.

Positioning has been another headwind. CFTC data (as compiled by market calendars) show speculative net positions in Canadian-dollar futures at −107,200 contracts on September 19, indicating investors were leaning against CAD. Such positioning can make negative surprises for Canada (or positive ones for the U.S.) move CAD/USD a bit faster.

Putting the pieces together: a 2.50% policy rate in Canada versus a 4.00%–4.25% range in the United States, guidance that Canada could cut again if needed versus a more measured tone from the Fed, August CPI at 1.9% y/y with −0.1% m/m unadjusted (+0.2% seasonally adjusted), oil clustered in the mid-$60s for Brent and low-$60s for WTI, and speculative CAD shorts near −107k—all coincided with a mild weakening of the Canadian dollar.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media