Summer’s surge: U.S. stocks rally from April lows into late August

Aug 26, 2025 | Featured, Business

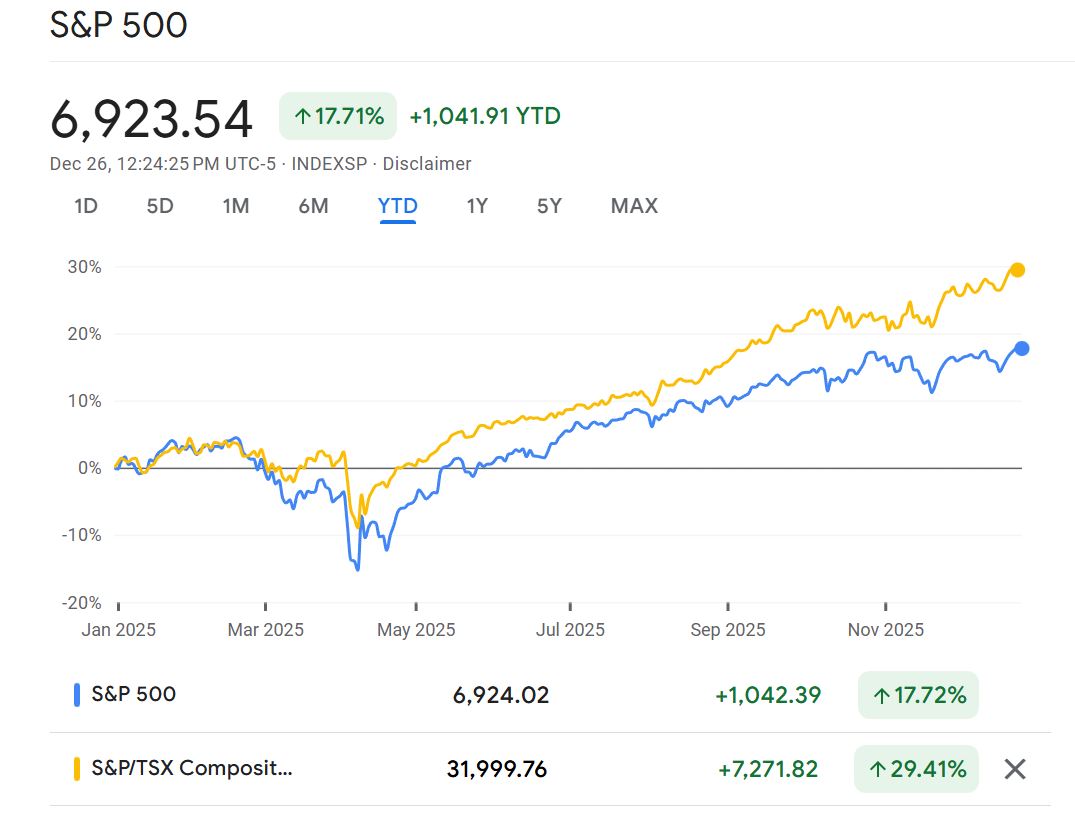

On March 31, 2025, early tariff shocks kicked off market turbulence. The S&P 500 plunged from about 5 397 to 5 074 on April 4—a one day drop of roughly 6 percent. On that same day, the Dow Jones dropped from about 40 546 to 38 315, falling nearly 5.5 percent, and the Nasdaq Composite slid from approximately 16 551 to 15 588, also a one day loss of about 6 percent.

But the sell off proved temporary. By August 25, the S&P 500 had climbed to 6 439, the Dow had reached 45 282, and the Nasdaq stood at 21 449. From those April lows, gains had totaled approximately 27 percent for the S&P 500, 18 percent for the Dow, and 38 percent for the Nasdaq.

Year to date as of August 25, the S&P 500 was up about 9.5 percent, the Dow up approximately 6.4 percent, and the Nasdaq led with an 11.1 percent gain. This strong summer rebound erased much of the volatility from spring and reestablished investor confidence.

Last week, markets shook off recent gains briefly. Investors grew cautious ahead of Federal Reserve commentary and key economic data. But then came Friday: Fed Chair Jerome Powell gave remarks interpreted as signaling a shift toward accommodative policy, boosting rate cut hopes and sparking a solid rebound across markets.

The market’s resilience this summer reflects a sharp revival in sentiment following April’s turbulence. Trade tensions softened, inflation data cooled modestly, and earnings—particularly from AI driven tech firms—remained encouraging. Nvidia’s influence looms large; as a major AI chipmaker, its upcoming earnings report is being closely watched to gauge whether momentum can hold.

Within sectors, healthcare underperformed recently, while tech stocks showed relative strength even amid the late August shift. Consumer staples also weighed on the indexes, while upbeat corporate news—for example, the Nvidia stock pulse ahead of earnings—helped keep dips shallow.

To sum up, from early April to late August 2025, U.S. stocks turned a sharp sell off into a robust rally. The market now looks to upcoming earnings and inflation data to sustain momentum—or signal a shift. All three major indices reached fresh all time closing highs in August: the S&P 500 closed at 6 467 on August 22, tying its record; the Nasdaq Composite closed at 21 713 on August 13, its all time high; and the Dow Jones hit a record closing high of 45 632 on August 22.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media