Watch BOC rate decision and commodity prices.

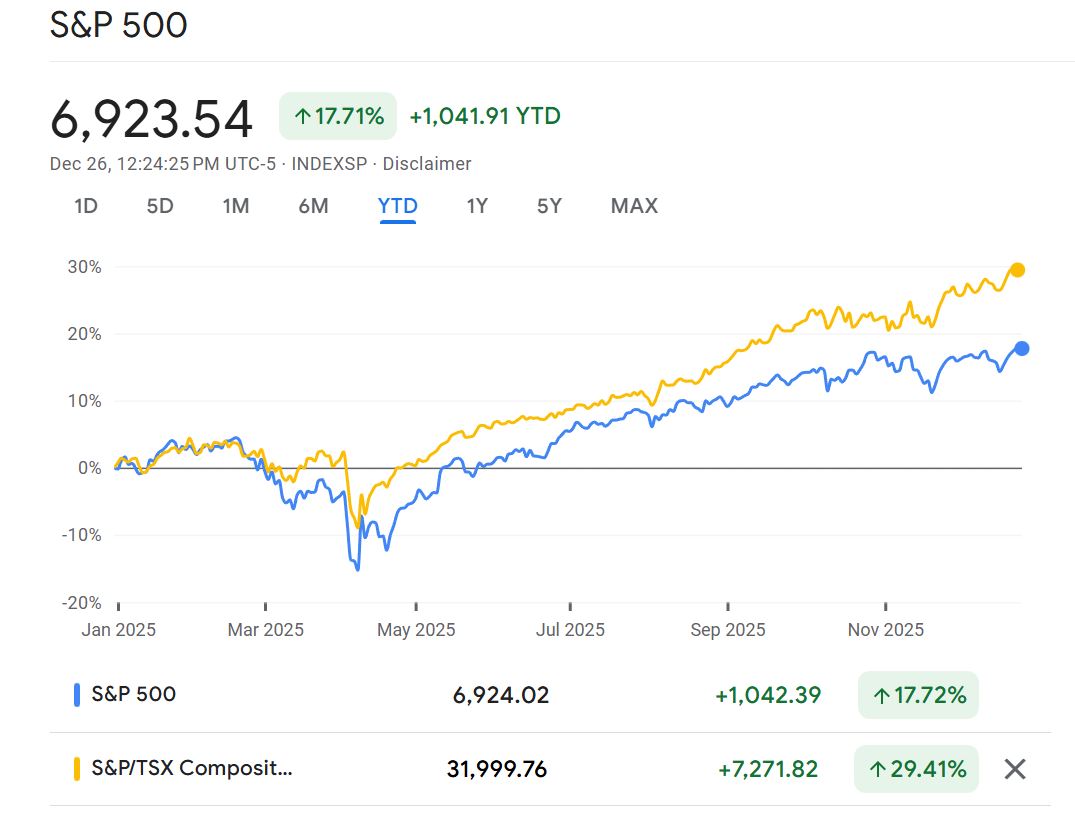

Canada’s stock market is so far having a strong year. On December 31, 2024, the S&P/TSX Composite closed at 24,728. By October 24, 2025 it was around 30,300, putting year-to-date gains near 22%.

October has seen numerous news for the index highs, especially at the beginning of the month, driven by strength in technology and commodities and expectations that the Bank of Canada will cut interest rates at the end of the month.

Several factors have been driving the gains.

- Interest rates have moved lower in Canada. The Bank of Canada cut its policy rate by 25 basis points each time in January, March, and September, bringing it to 2.50% on September 17, with another decision due October 29. Cheaper borrowing tends to support banks, rate-sensitive sectors, and overall market valuations.

- Oil and commodities have had many good days to lift the market’s heavy resource groups. When crude rallied late last week, energy stocks rose about 2% and helped the index hold above the 30,000 level.

- Several well-known growth stocks have helped the index. Shopify’s strength, for instance, helped the TSX reach fresh records at the start of October. Technology is still a much smaller slice of the TSX than in the U.S., but on strong days it adds a noticeable lift to the index. There have been several setbacks to the general positive trend. Trade and tariff turbulence created a rough patch in March and April which reared its ugly head just last week. The TSX saw sharp one-day drops in those periods. But the pullbacks were brief relative to the overall climb.

So, the pattern for the S&P/TSX Composite looks like the following: Energy and materials have benefitted from stronger commodity prices; financials have gained on the interest rate cutting environment; technology stocks rise with the gains in AI and chip stocks in the U.S.; and consumer sectors provided steady but smaller gains.

The combination – lower rates at home and higher commodity prices – has been good for Canadian equities this year.

Investors will need to watch two major factors going forward:

- The Bank of Canada’s October 29 interest rate decision and company earnings. If there is another interest rate cut with the Bank of Canada guiding to continue the steady lower rate path, that should keep pressure off consumer funding costs and support stock valuations.

- Continued strong commodity prices should help the materials sector maintain positive momentum.

If either of those two factors deteriorate, the S&P/TSX index could see a backtrack after recent strong run.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media