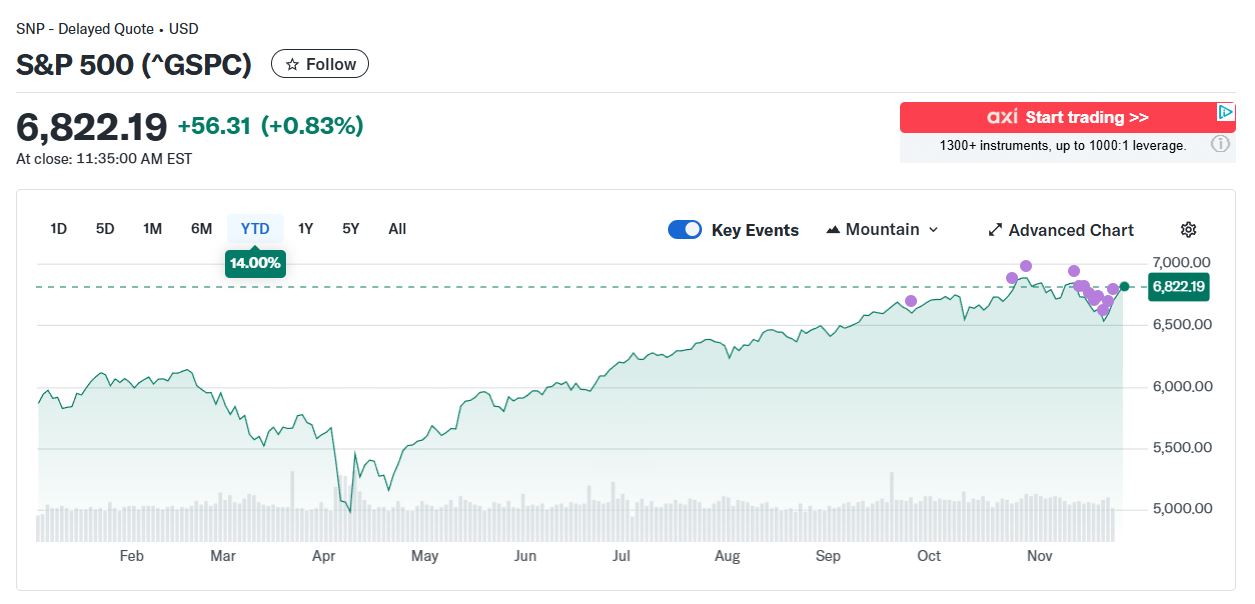

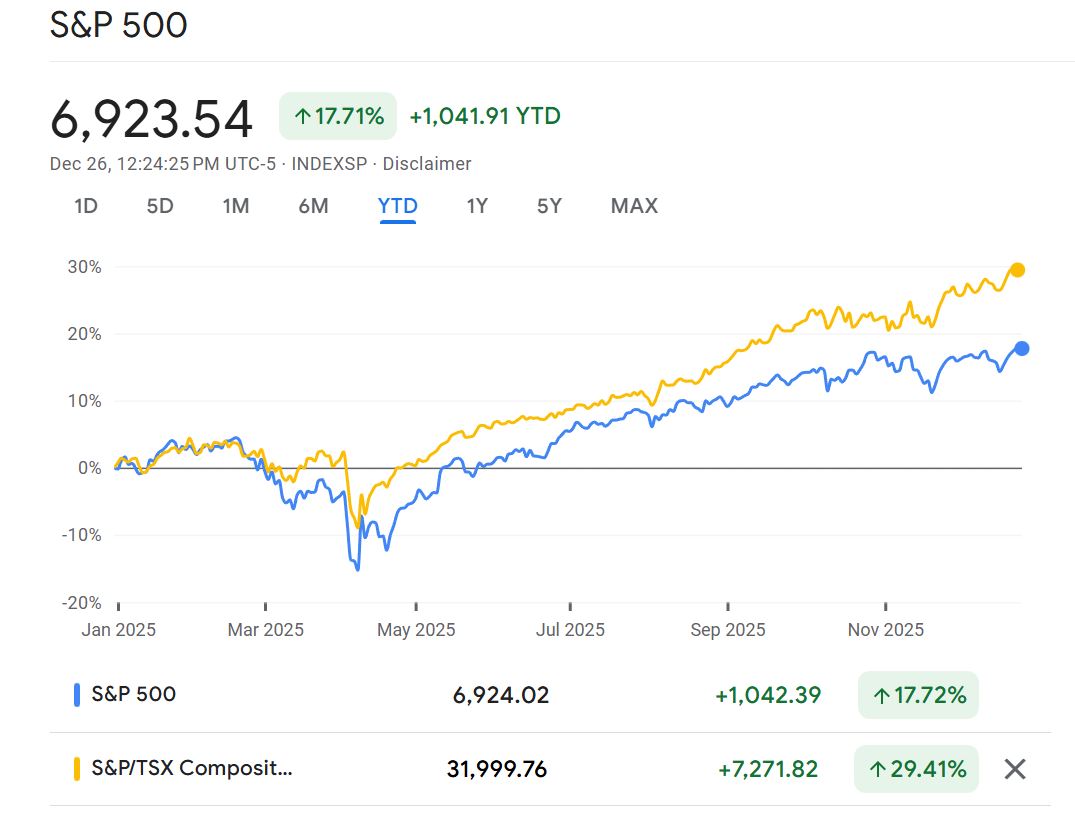

But Canada is still outpacing the U.S.

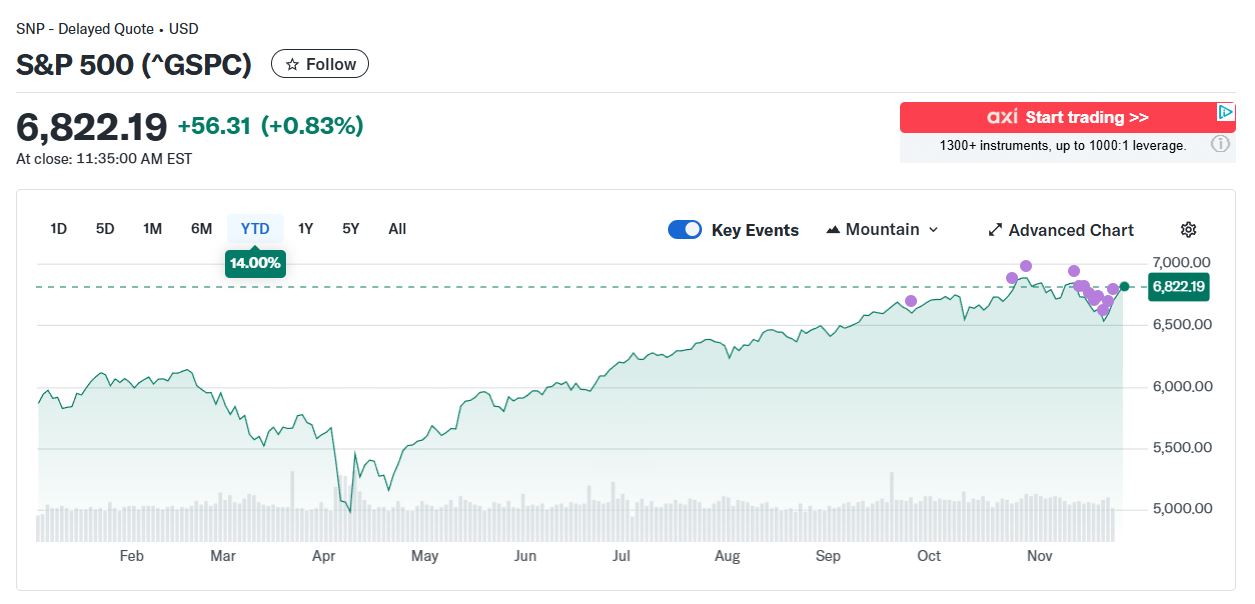

Year to date, Canada’s S&P/TSX Composite is up roughly 24%, rising from 24,728 at the end of 2024 to around 30,600 in late November. On November 12 it set a record closing high of 30,827.60. The U.S. S&P 500 is up about 14% over the same stretch. That’s a difference of roughly 10 percentage points in Canada’s favor.

Why did both markets rise after the most recent rate cuts, yet by different amounts?

When central banks cut rates, the discount rate used to determine future value is lowered, increasing future value of corporate earnings, and can help companies pay less interest, which also can lift companies’ profit forecasts (these forces become reflected in higher stock prices).

On October 29, 2025, both the Bank of Canada and the U.S. Federal Reserve cut policy rates by 0.25 percentage points. The BoC’s target for the overnight rate moved to 2.25%. The Fed also lowered administered rates, including the interest rate on reserve balances, to 3.90%. Those decisions supported share prices on both sides of the border.

However, over the past eleven months, the Bank of Canada cut its policy rate four times, totaling 100 basis points. The Fed over this period made just two cuts, totaling 50 basis points. This was part of the reason why the U.S. stock market advance this year (about low-teens) has been less spectacular than in Canada.

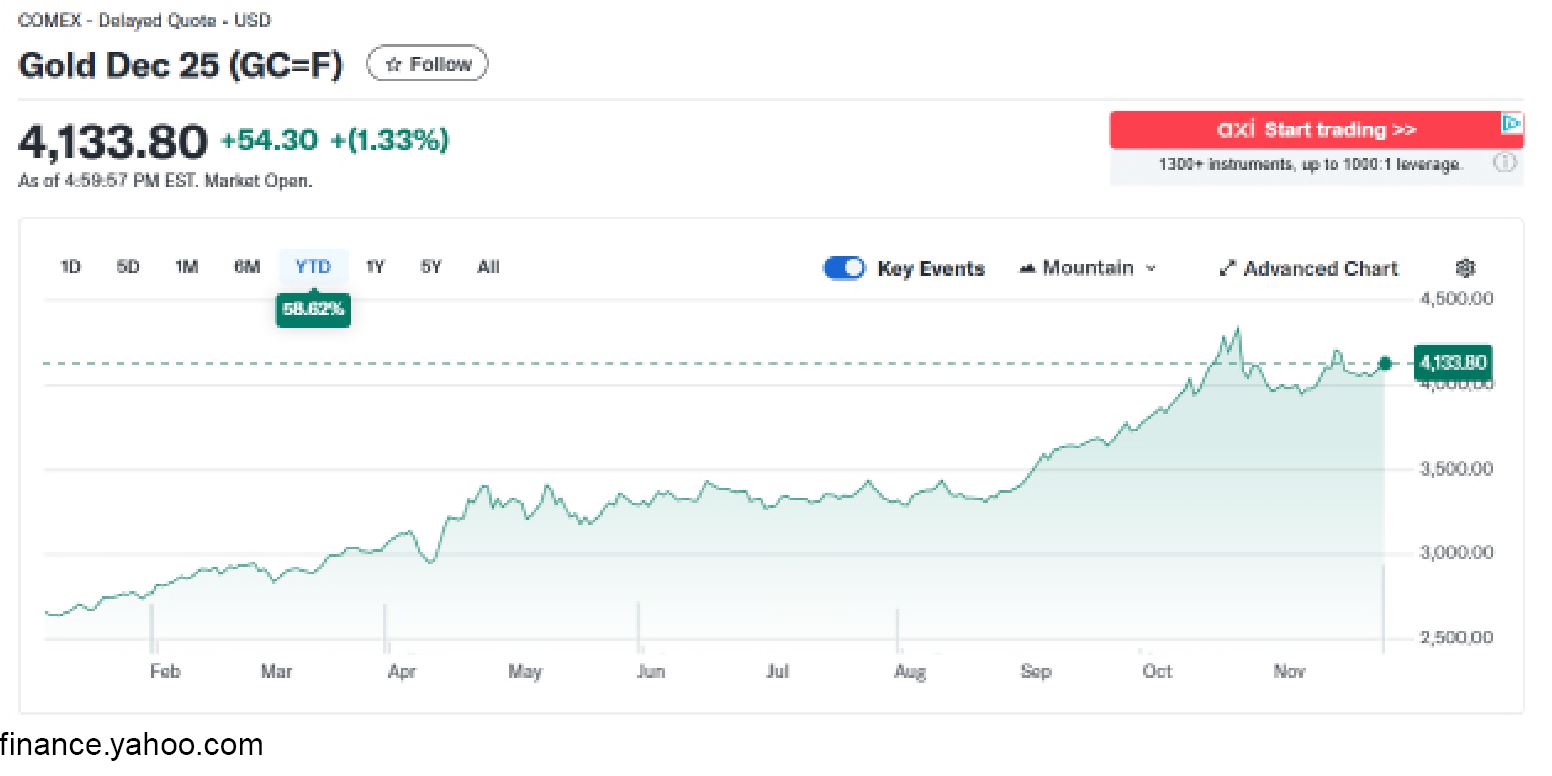

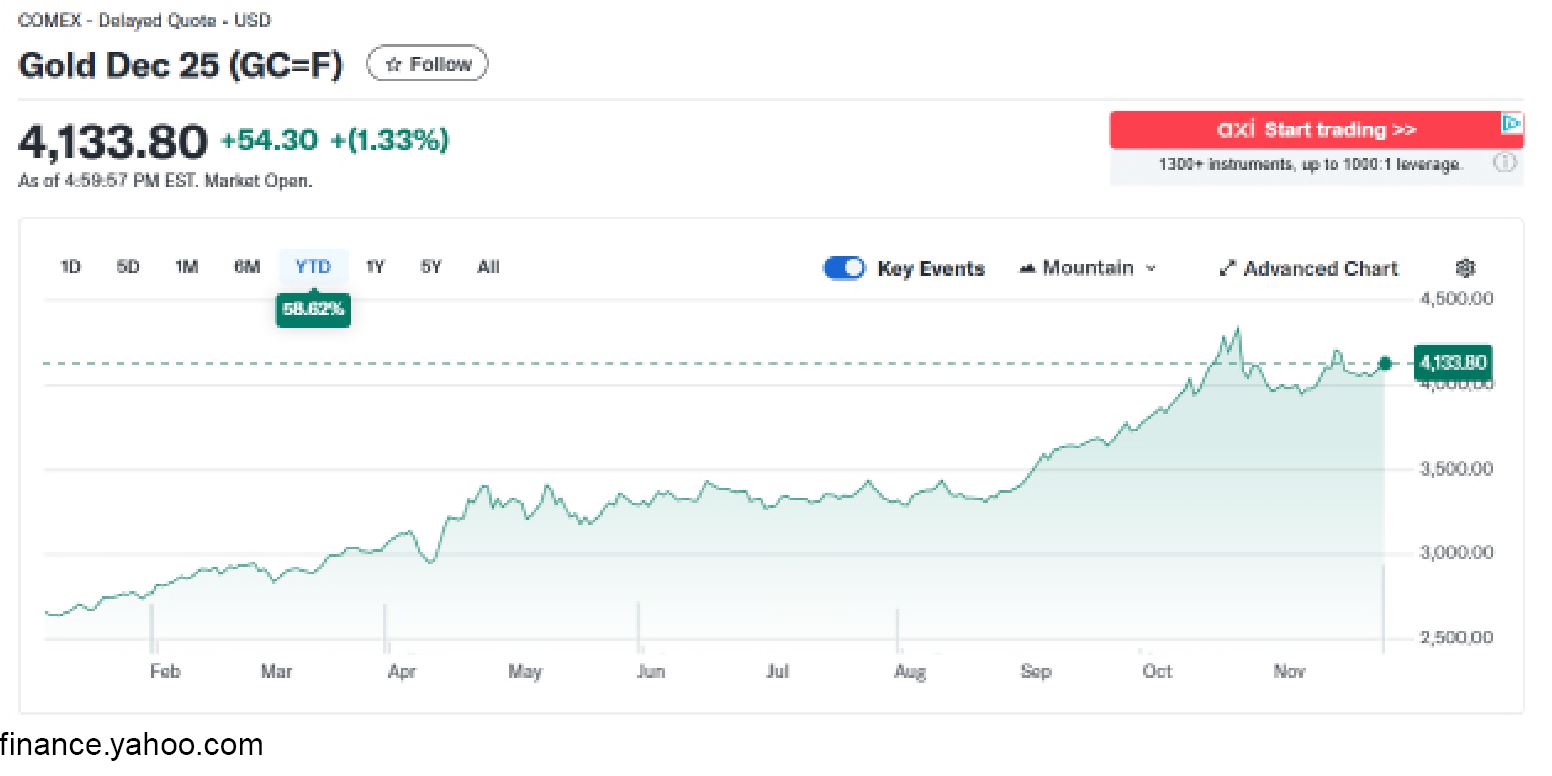

The other big reason that Canada’s TSX Composite is outperforming this year is the commodity price rally (gold and uranium especially, a little less with other metals such as lithium, zinc, copper, nickel) – given TSX Composite’s 12.5% weight in materials (the S&P 500 Index only has a 1.68% weight). These pushes, combined with lower rates, left the TSX near record territory in November.

Going forward, the gap between the U.S. and Canadian stock markets may shift again. In the U.S., earnings updates from large companies can speed things up or slow them down. In Canada, weeks when oil or gold soften can cool the TSX even if interest rates are a bit lower; firm commodity weeks do the opposite. As more data arrive on inflation, jobs, and growth, investors adjust how many further cuts they expect.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media