In this article we continue our analysis of fixed income. In earlier articles, we wrote about government bonds, which are generally considered the least risky, and investment-grade corporate bonds which also provide a higher degree of comfort for investors.

Here, we would like to focus attention on high-yield bonds, which in the current low interest rate environment provide higher yields, but are also a higher risk investment. Due to the higher risk, these bonds are also referred to as speculative-grade, or junk bonds.

In the classification used by two of the major credit rating agencies, Dominion Bond Rating Service (DBRS) and Standard and Poor’s, high-yield bonds carry ratings starting from a high of BB+ to C- at the highest risk level before actual default, where the rating is designated D.

High-yield bonds carry lower ratings for a good reason. According to Wikipedia, through 2007, the default rate among high-yield rated entities as estimated by S&P was 7.4% for municipal bonds and 42.4% for corporates. For comparison, the investment grade bonds default rates were much lower, 0.2% and 4.1%. This is why many pension funds and other regulated institutional investors (banks, insurance companies) are often prohibited from holding such bonds.

The higher risk associated with speculative-grade bonds is compensated by higher yields and potentially higher returns. High returns on junk bonds come from higher coupons. Often, bond market players are able to capitalize on significant fluctuations in prices of junk bonds in secondary market trading when credit ratings or outlooks change. Given the poor transparency of bond markets in general, it is not advisable for individual investors to trade in junk bonds on their own, as they will not be able to get the same pricing opportunities that institutional investors can. Thus, it is best to invest in junk bonds through mutual funds or ETFs that focus on this asset class.

Another advantage of using funds or ETFs when investing in high-yield bonds is the ability to diversify investments in a variety of high yield bonds that comes with the purchase of one mutual fund or ETF – this is the cheapest and most efficient way for an individual investor to accomplish this.

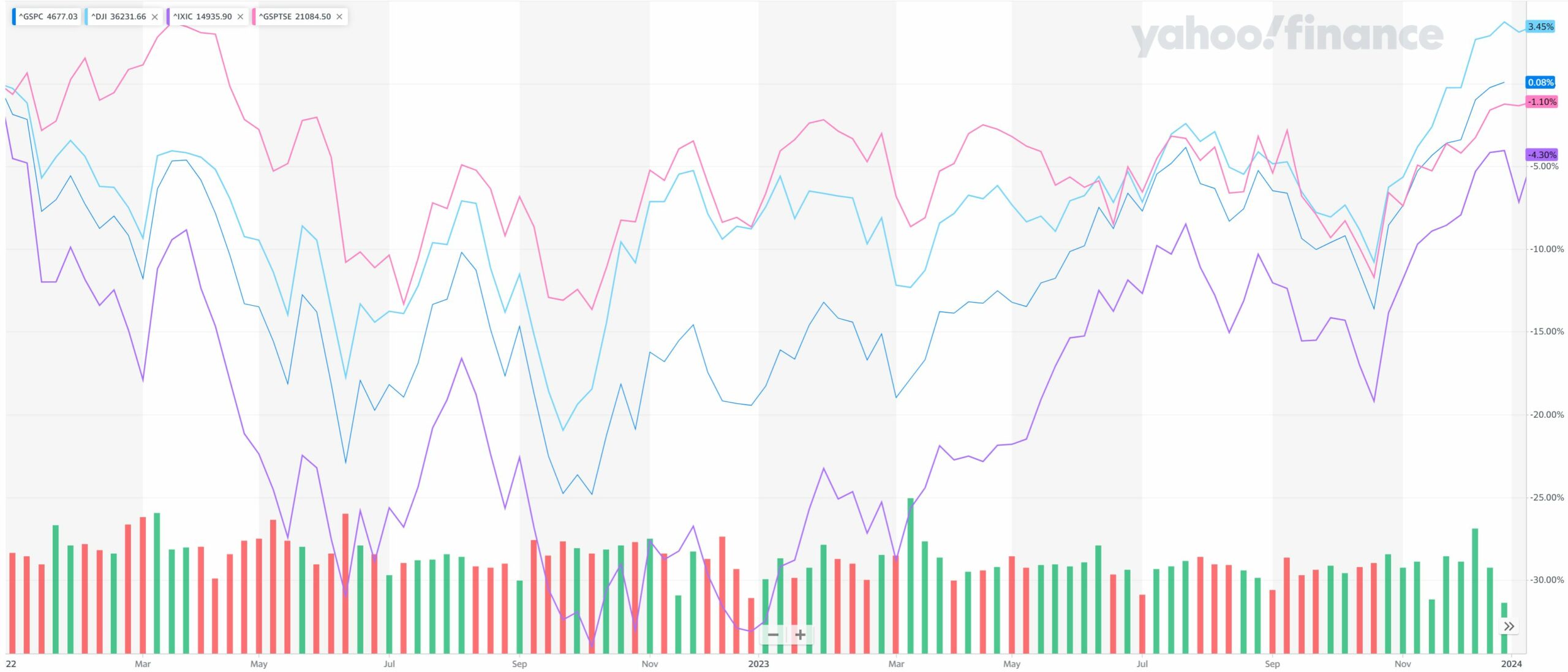

In the risk matrix of various securities, high yield bonds are located between investment-grade bonds and preferred shares. The obligation to make regular and timely coupon payments, along with the obligation to repay the principal, makes high yield bonds a lower risk security than stocks. Returns on high yield bonds historically have tended to be less volatile than returns on equities.

According to calculations by the investment management firm Peritus Asset Management, speculative-grade bonds provide better risk adjusted returns than equities. Based on the data for the 15-year period preceding 2012, high yield bonds had performed better than equities and have done so with less risk (as measured by the volatility of returns). Over each time period (one-, three-, five-, ten-, and 15-years before 2012), high-yield bonds, represented by Credit Suisse High Yield Index, had much better results than equities represented by S&P 500 Index.

Michael Zienchuk, MBA, CIM

Investment Advisor, Credential Securities Inc.

Manager, Wealth Strategies Group

Ukrainian Credit Union

416-763-5575 x204

[email protected]

Mutual funds and other securities are offered through Credential Securities Inc. Commissions, trailing commissions, management fees and expenses all may be associated with mutual fund investments. Please read the prospectus before investing. Unless otherwise stated, mutual funds and other securities are not insured nor guaranteed, their values change frequently, and past performance may not be repeated. The information contained in this article was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete. This article is provided as a general source of information and should not be considered personal investment advice or solicitation to buy or sell any mutual funds and other securities. The views expressed are those of the author and not necessarily those of Credential Securities Inc.®. Credential is a registered mark owned by Credential Financial Inc. and is used under licence. Credential Securities Inc. is a Member of the Canadian Investor Protection Fund.

Share on Social Media