American stocks close to recouping tariff-related losses, Canadian market at record highs

Jun 25, 2025 | Featured, Business

Source: finance.yahoo.com

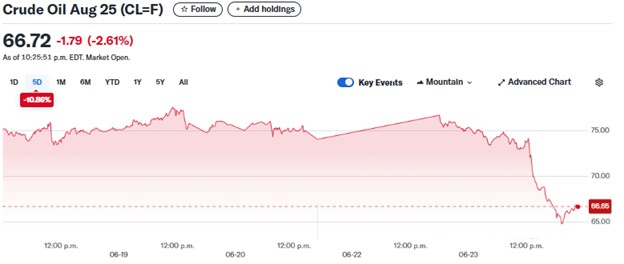

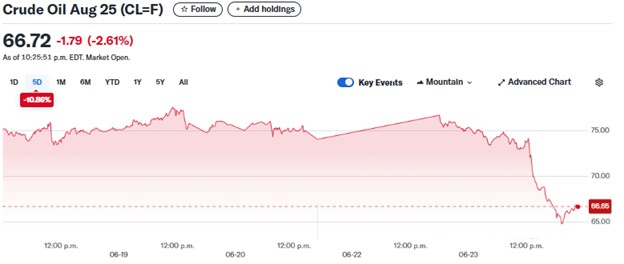

On Monday, the subdued Iranian response to the US airstrikes on Iranian nuclear facilities led to a relief rally in the American stock market. With the immediate threat to the vital Strait of Hormuz shipping lane perceived over, all three of the major American indices (Dow Jones Industrial Average, S&P 500 and NASDAQ) closed higher, and oil prices fell by more than 7%. Earlier in the trading session on Monday, the stocks and oil prices were moving in the opposite directions, but the good news from the Middle East lead to the turnaround.

Source: finance.yahoo.com

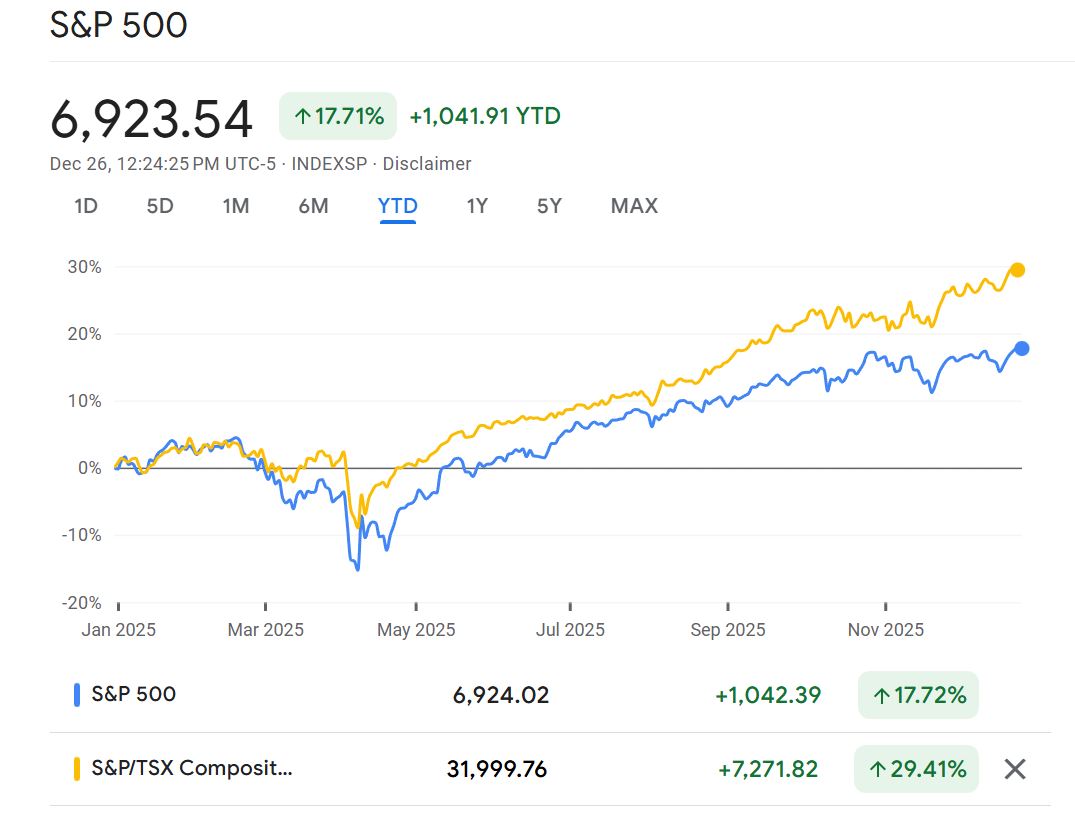

As of Monday’s close, the major American index, S&P 500 was at 6,025 points, just 1.7% lower than its all-time high posted on February 18. Since the market low caused by the Trump tariff turbulence, posted on April 8, the index shot up by almost 21%.

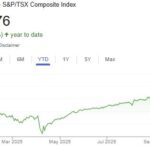

The main Canadian stock index, S&P/TSX Composite, also finished Monday on the positive note, up 0.42%. The Monday reading, 26,609 points, was 18% up from the low posted on April 8. Since mid-May, the Canadian index has been in the record territory, thanks to the period of relative calm in the Canada-US relations after the selloff, triggered by tariff announcements.

As David Rosenberg explained in the Financial Post, Canadian industrials and financials performed well during this period. What investors liked in the latest banking sector reporting season was the move to get ahead of the consumer delinquency cycle and sharply bolster loan loss reserve provisioning. Another factor of the Canadian market’s strength came from the gold miners’ price performance, boosted by the recent rally in gold prices to around US$3,400 per ounce and up nearly 30% year to date. The S&P/TSX Composite index includes 27 mining companies that comprise a 9% share of the index. Rosenberg estimates that the exposure of the Canadian index to precious metals has been responsible for half of the 8% advance of the index in 2025.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media