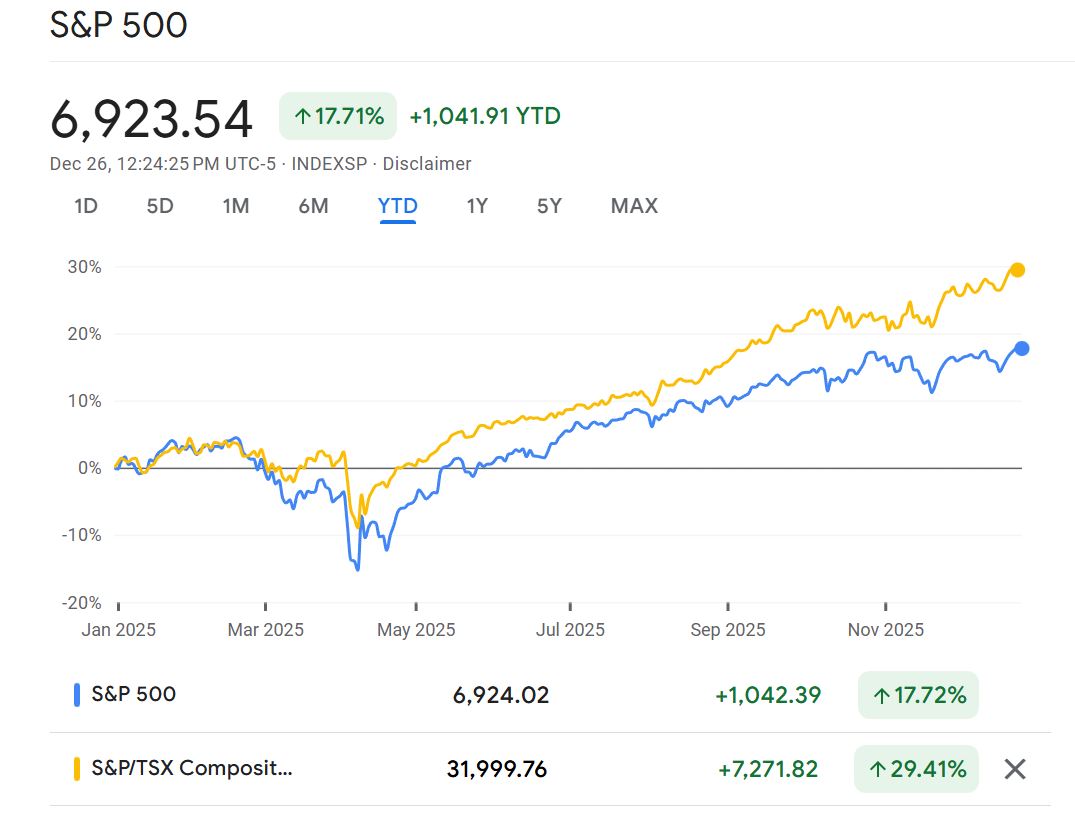

Canada’s TSX beats America’s S&P 500 in a year of rate cuts

Dec 26, 2025 | Featured, Business

During the trading on Friday, December 26, both U.S. and Canadian stock markets were firmly positive for 2025, with Canada further ahead. The main American index S&P 500 was up more than 17% year to date. Canada’s S&P/TSX Composite grew by over 29% so far this year.

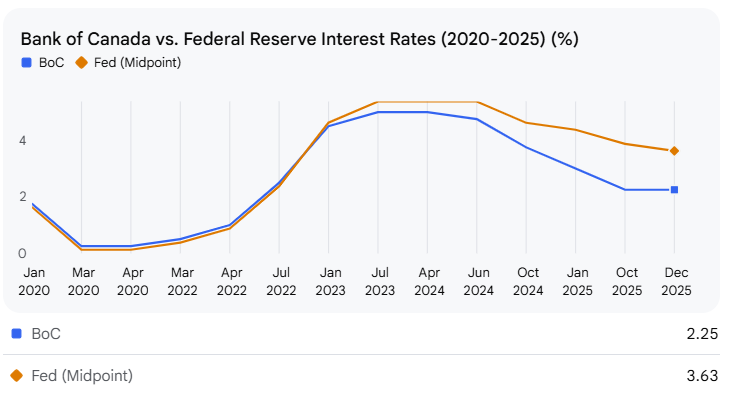

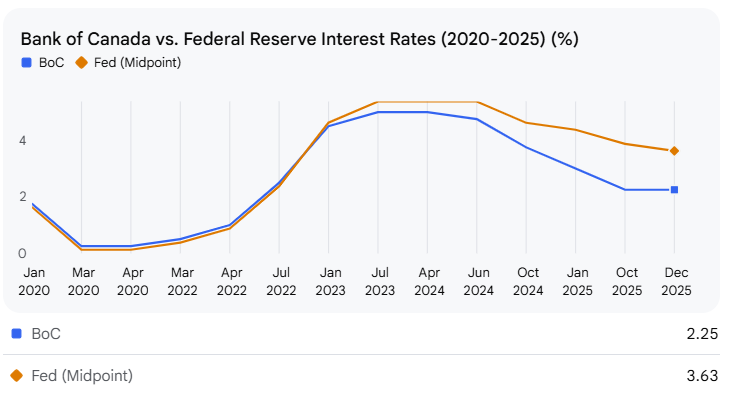

Interest rates did a lot of the lifting. The Bank of Canada cut four times in 2025: January 29 (to 3.00%), March 12 (to 2.75%), September 17 (to 2.50%), and October 29 (to 2.25%). It then held at 2.25% at the December 10 announcement. The U.S. Federal Reserve started later and cut three times: September 17 (to a 4.00%–4.25% range), October 29 (to 3.75%–4.00%), and December 10 (to 3.50%–3.75%). In short, four moves in Canada versus three in the U.S., the U.S. Federal Reserve ended the year with its federal funds target range noticeably higher than the Bank of Canada’s rate.

Source: Google.com

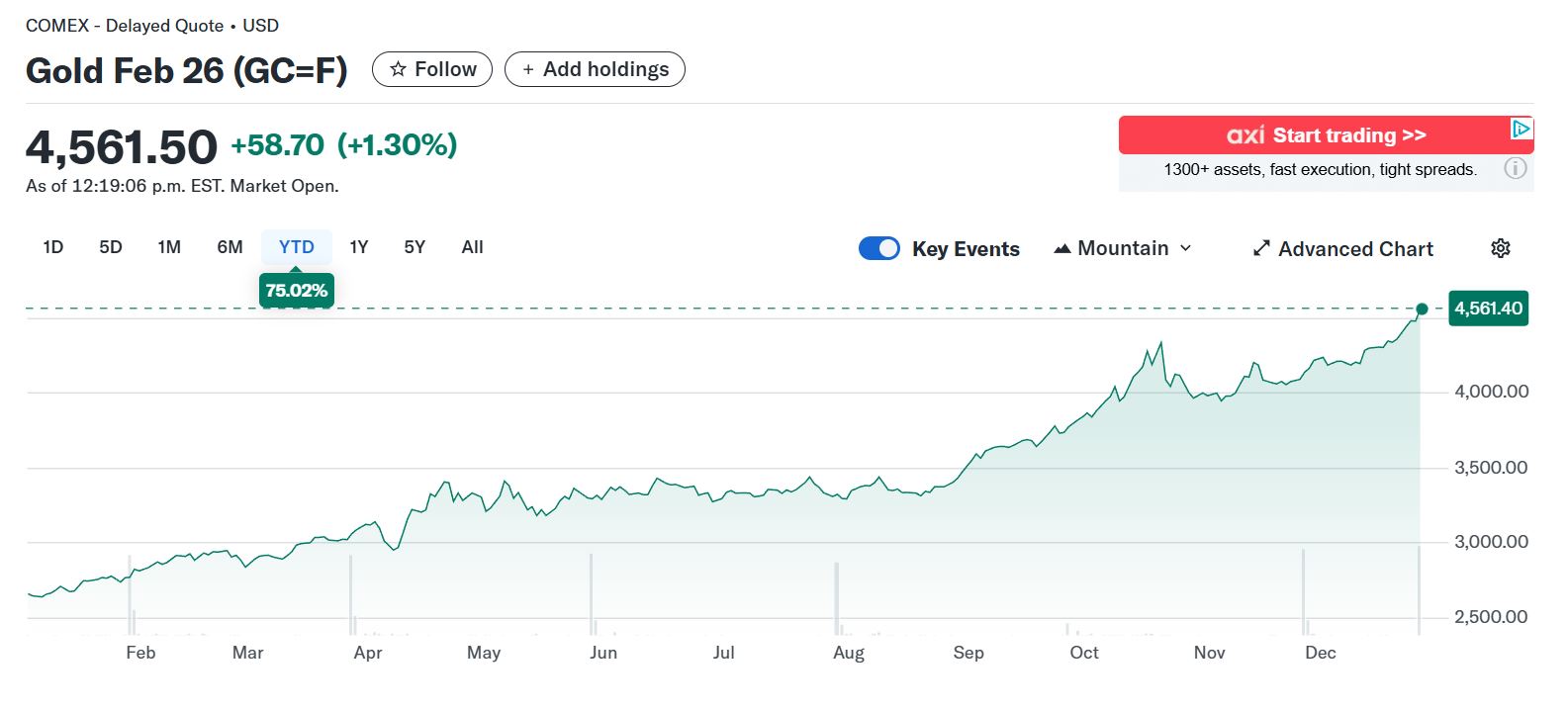

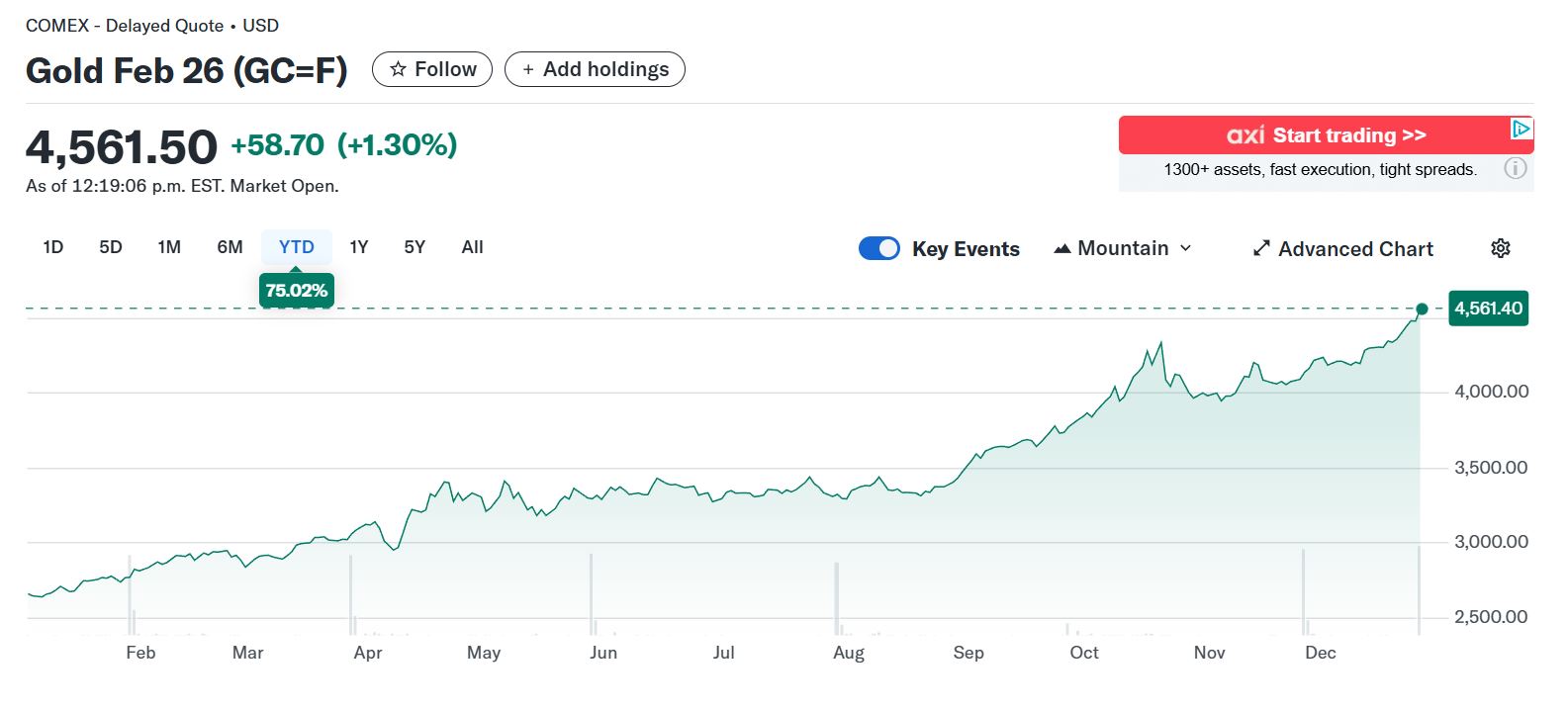

What each market is made of explains the rest. In Canada, banks and resource companies take up a large share of the index: financials are roughly a third of the TSX, while energy and materials together are about another 30%. When rates fell, funding costs and credit worries eased a bit for banks, which helped a large part of the index. Resource names found periods of support when commodity prices were firm. For example, U.S. West Texas Intermediate crude has settled around $56.5 a barrel, a level that supports cash-flow expectations for many producers and pipelines. While gold has added over 75% year-to-date.

Source: finance.yahoo.com

The U.S. picture was different. The S&P 500 is dominated by very large technology and communication-services companies, and technology alone accounted for over a third of the index late in the year. These firms spend heavily on chips, data centers, and software. Even a small step down in borrowing costs helps those plans. That leadership kept the S&P 500 in solid gains, though the overall rise was smaller than Canada’s because there was less help from banks and resources. Energy and materials are a much smaller slice of the U.S. index, so firm oil and gold did not add as much broad support as they did in Canada. Also, the Fed delivered fewer total cuts than the Bank of Canada in 2025, so the rate effect was milder in the U.S. index as a whole.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media