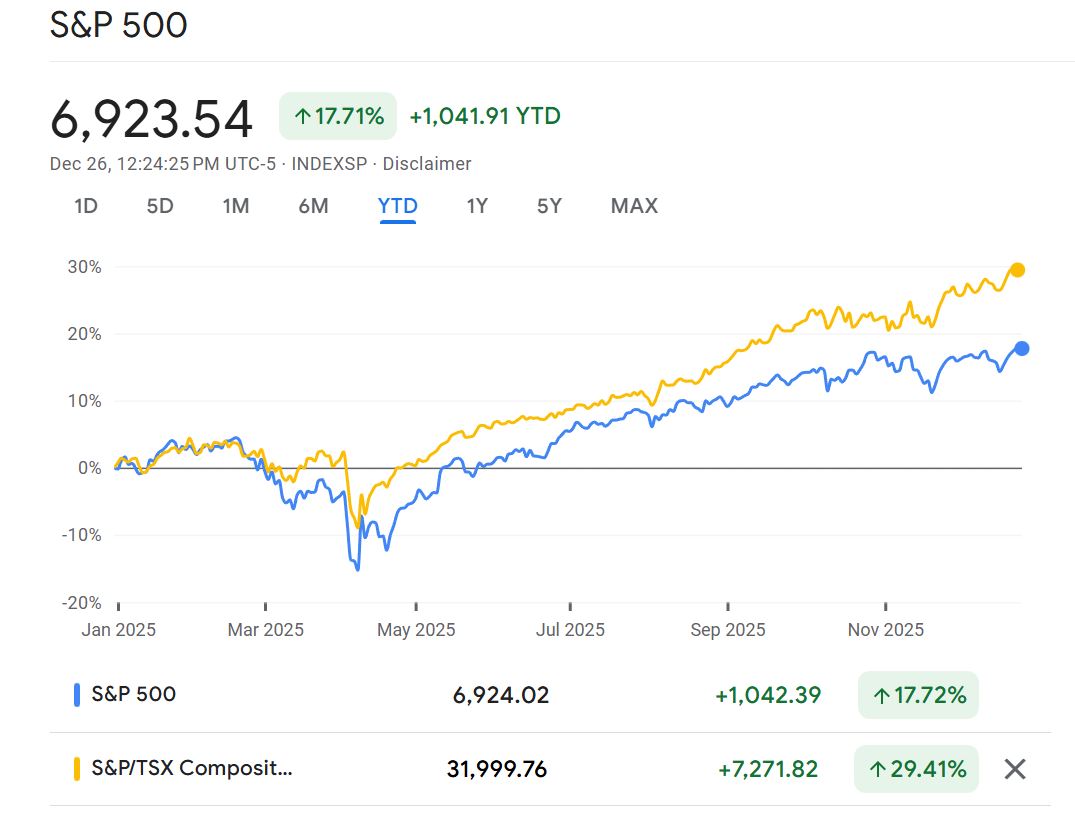

North American stocks break records and finish first half of 2025 on a positive note

Jul 2, 2025 | Featured, Business

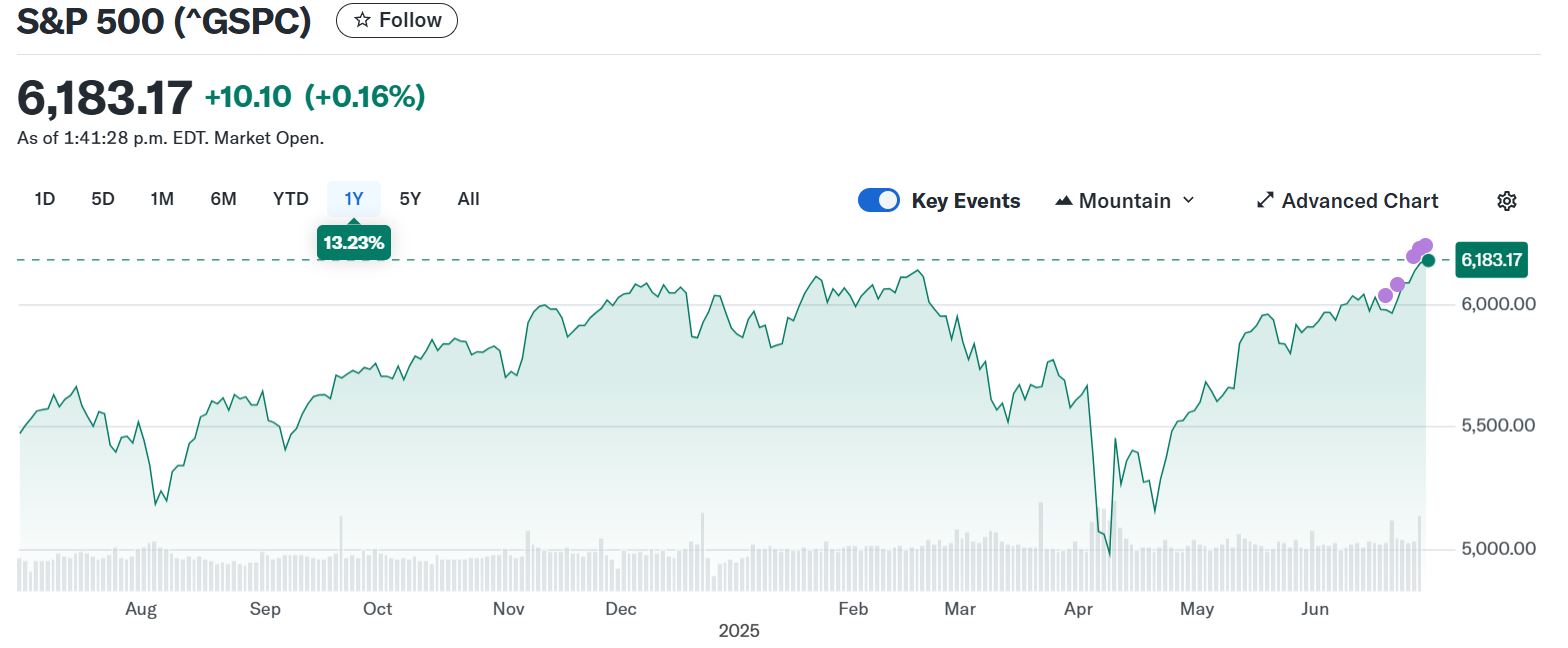

The major American stock index, S&P 500, broke its all-time-record on Friday, June 27 and closed at over 6,183 points.

The index set a previous record on February 19 while the recent low was registered on April 8 amid fears that sweeping tariffs introduced by President Trump would hurt the global economy. Now, one of the most volatile first halves of a year in recent memory is ending on a positive note.

On Monday June 30th, the index continued climbing amid signs of progress in trade talks and reached 6,205 points. Hopes are rising that the US and its top trading partners are close to striking trade deals. Canada scrapped its digital services tax targeting US tech companies on Sunday, just hours before it was set to start collecting payments, to try and revive stalled trade negotiations with the US. Also on Sunday, President Trump said he didn’t think he would need to extend sweeping US “reciprocal” tariffs on July 9th.

The question that market players are asking now is what is ahead for the stock market for the second half of the year, especially considering widespread conversations about possible market weakness over the summer months?

In the nearest days, the market actors are watching closely Senate negotiations over Trump’s proposed $4.5 trillion tax cut bill which is estimated to add $3.3 trillion to the U.S. deficit over a decade. The American June jobs report will be a highlight towards the end of the week, as markets are growing optimistic that the Federal Reserve could lower interest rates soon.

Going forward, Truist co-chief investment officer and chief market strategist Keith Lerner told Yahoo Finance’s Morning Brief that the dominant theme of the current bull market is AI and tech, supporting the semiconductor and industrial sectors, which could continue rising.

The main Canadian index, S&P/TSX Composite, continued its climb on Monday, on positive news about the revival of trade talks between Washington and Ottawa. At over 26,857 points, the index finished its fourth straight quarter in positive territory. Since the low in early April, the index is already up by almost 20%.

finance.yahoo.com

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media