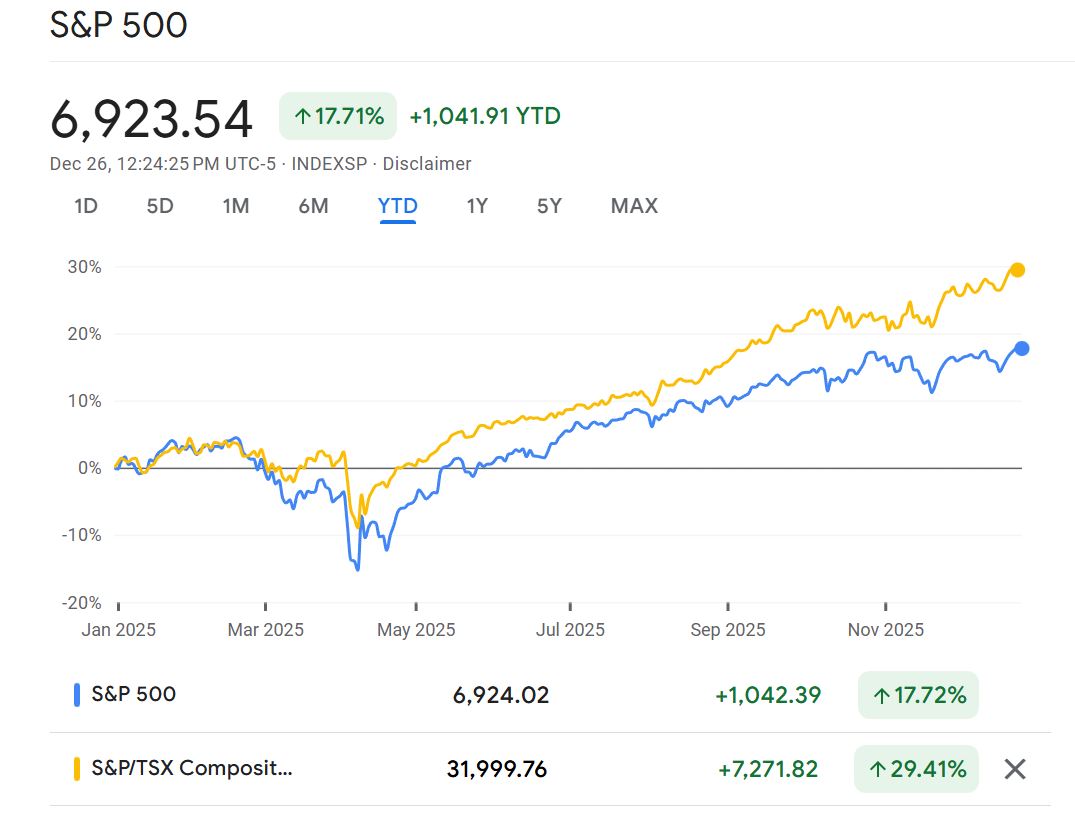

After China tariffs reprieve and lower inflation S&P 500 is on the winning streak

May 13, 2025 | Featured, Business

S&P/TSX Composite Index has outperformed the key US index S&P 500 this year

President Donald Trump’s agreement with China to temporarily reset lower tariffs for 90 days brought a sigh of relief to capital markets. The Trump administration agreed after talks last weekend in Switzerland to pare back its 145% in tariffs charged on imports from China to 30%. The Chinese government chose to reduce its retaliatory import taxes on U.S. goods from 125% to 10% while the sides continue to negotiate.

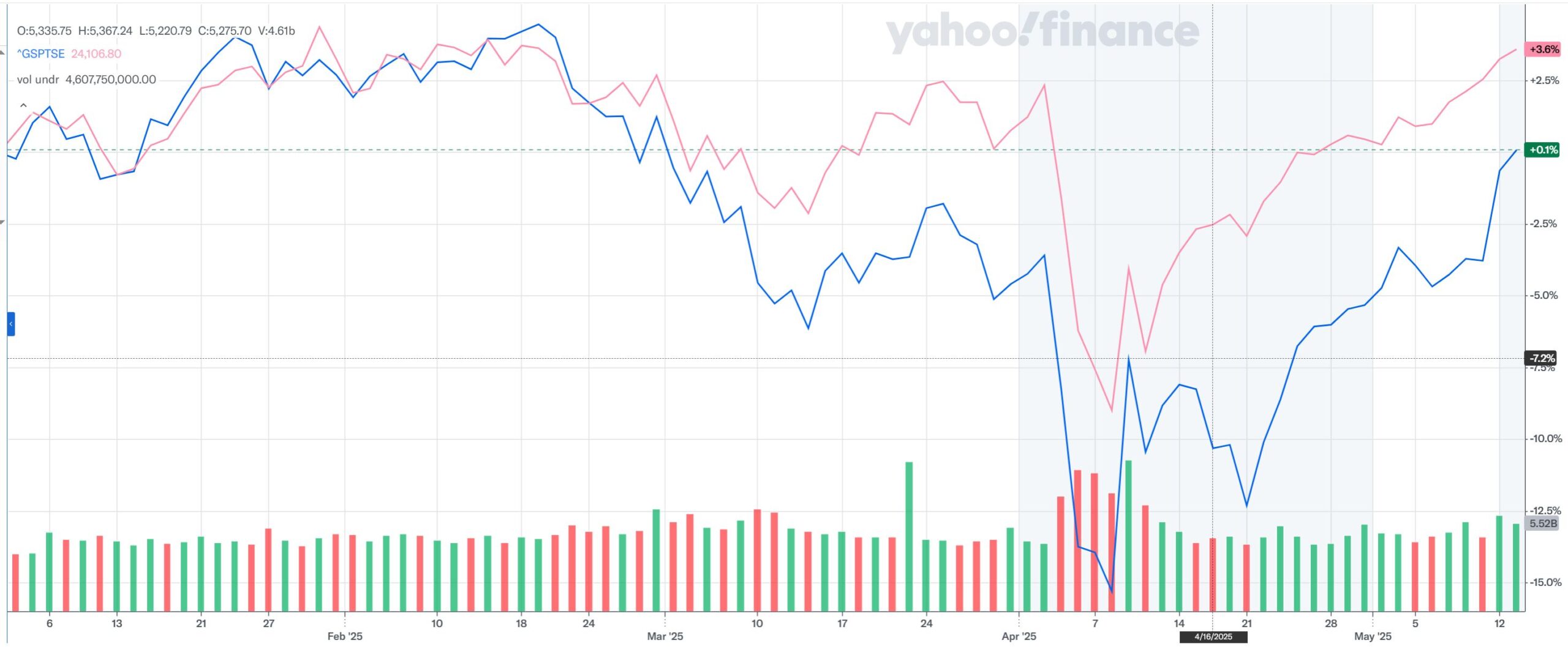

On Monday, US stocks surged and closed near the highs of the day. The S&P 500 jumped nearly 3.3% to its highest level since March 3. On Tuesday, US stocks had another positive day, fifth in a row, with tech stocks rallying for the second session. Investors were enthusiastic about shares of Big Tech mega-caps hurt by trade war worries. Semiconductor chip leader Nvidia jumped more than 5%, with Amazon, Apple, and Tesla also rising. The optimism was also due to the latest consumer inflation report which revealed easing prices in April. The S&P 500 rose 0.7%, and is now up 6 points year-to-date and around 12% in the past 12 months. S&P 500 has erased much of the decline which happened in late February – March, after the first tariff announcements. At that time, the index was close to bear-market territory, having fallen on April 8 by almost 19% from its all-time-high posted on February 19.

The main Canadian S&P/TSX Composite Index has outperformed the key US index S&P 500 so far this year, climbing 3.6% compared to the S&P 500 Index’s 0.1% growth as of Tuesday. The Financial Post noted that gains in Canada have primarily come from its large concentration of gold and silver miners, which have benefited as investors sought a safe haven while the US imposed tariffs on its trading partners.

At the same time, Canada’s main index has experienced a wide discrepancy between winners and losers ahead of a planned rebalancing announcement on June 6. The measurement period that determines which stocks join the index began last Friday and is expected to close on May 23.

Two precious metals stocks are poised to join Canada’s big board — Discovery Silver Corp. and Allied Gold Corp. — as well as auction house operator RB Global Inc., according to analysts.

Michael Zienchuk, MBA, CIM

Investment Advisor

Aviso Wealth

Manager

Wealth Strategies Group

Ukrainian Credit Union Limited

416-763-5575 x153

UCU Wealth Strategies is a division of Ukrainian Credit Union Limited. This material provides communication and not investment advice.

Mutual funds and other securities are offered through Aviso Wealth, a division of Aviso Financial Inc. The information contained in this email was obtained from sources believed to be reliable; however, we cannot guarantee that it is accurate or complete and it should not be considered personal taxation advice. We are not tax advisors and we recommend that clients seek independent advice from a professional advisor on tax related matters. This material is provided as a general source of information and should not be considered personal investment advice or a solicitation to buy or sell any mutual funds or other securities.

This is a paid advertisement

Share on Social Media